Playing For Keeps: Steam’s Q5 Releases

The fate of PC & Console’s (HD) live-service model hangs on Q5’s ambitious lineup: Strinova, Infinity Nikki, Path of Exile 2, Supervive, Marvel Rivals, and Delta Force. Should these titles fail to gain traction, the industry faces a cascade of down rounds, studio closures, and layoffs—not to mention a wholesale reassessment of the HD live-service paradigm. Eric Seufert‘s meditation on “The last social media platform” may prove prescient; we might witness the same in HD live service.

The warning signs are already apparent. Mountaintop Studios‘ venture-backed Spectre Divide has become a cautionary tale, with peak simultaneous users (PSU) dropping below 100. Supervive’s trajectory is similar, maintaining 4,000 PSU despite years of development, encouraging playtests, and the backing of the former League of Legends leadership team. Its salvation may lie in the East, given that 80-90% of Riot’s revenue flows from Eastern regions.

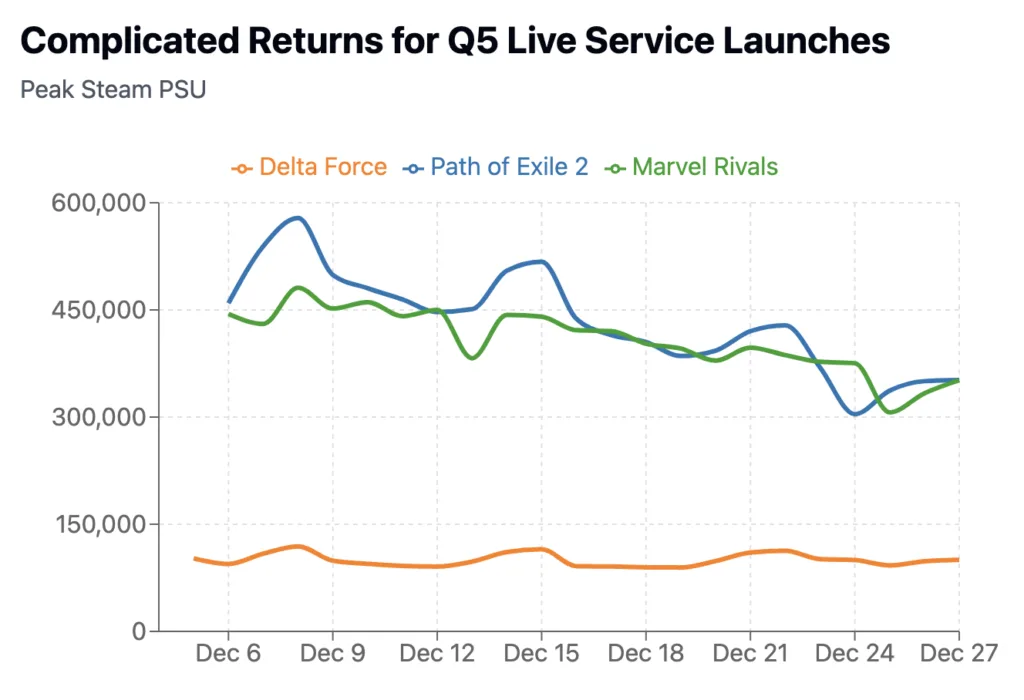

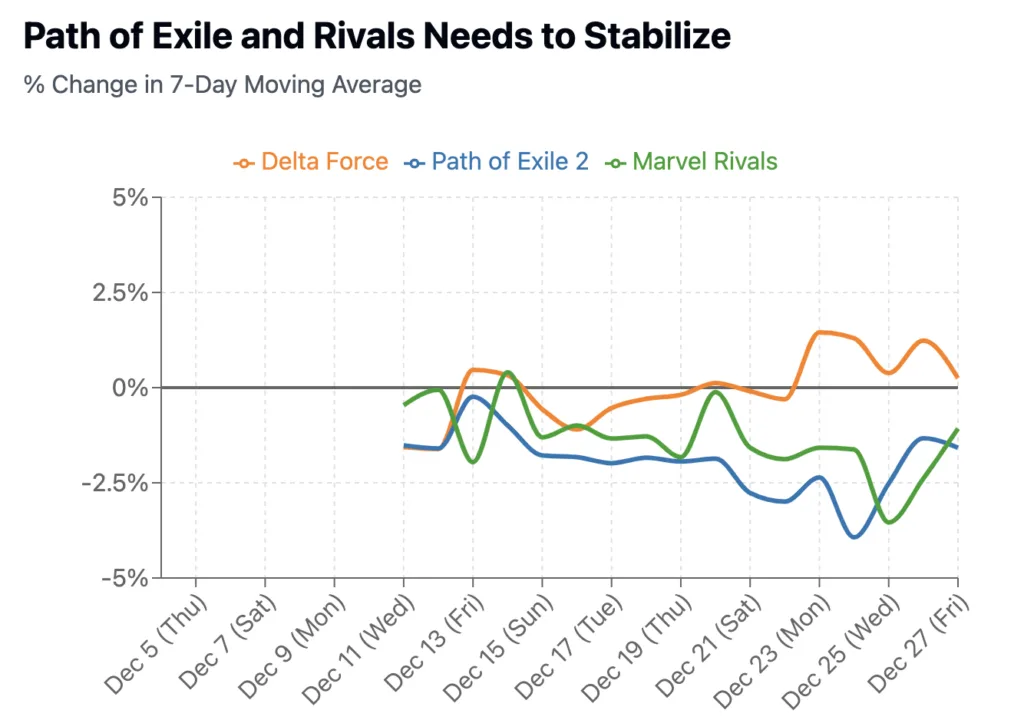

While the linear declines in Rivals and Path of Exile 2 (PoE) triggered alarm bells, the unfolding reality is more nuanced. Yes, engagement has declined, but from historic peaks. Both titles maintain a top-five Steam ranking and are inching toward PSU stability.

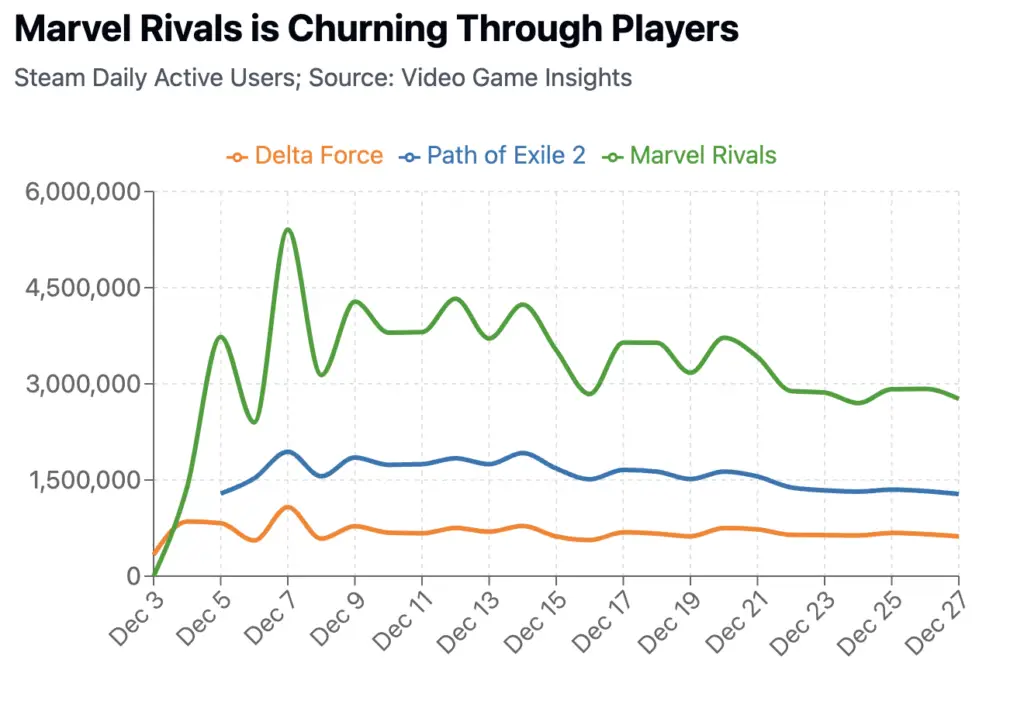

Video Game Insights‘ new daily active users metric highlights a fascinating disparity: despite nearly identical PSU curves, the gap in DAU between the two is stark. This isn’t a methodological quirk but reflects Rivals’ ripping through new players faster than a teenager through a PS5 on Christmas. PoE’s paid early access limits the casual “dating” that Rivals has seen. The upcoming Circana console rankings will prove particularly telling for Rivals and Eric Kress‘ grim pronouncement for the title.

Delta Force emerges as the dark horse, potentially overtaking PoE and Rivals through sheer stability. Its rock-solid stability is so stable it raises eyebrows; on the other hand, Steam’s military shooter audience—a unique demographic dominated by German detail-obsessed gamers who debate the historical accuracy of M1 Garand iron sights. Factor in China’s staggering 40 million pre-registrations across mobile and PC, the impending mobile launch, and Delta Force will have legs, even if the Western one is shorter.

For all the Q5 noise, Q1’s Palworld’s recent engagement bump reminds us to reexamine live-service go-to-market. We still haven’t figured out how to assemble variables like Early Access, F2P v. paid, console v. mobile, regional-locking, and Steam China into a coherent strategy. Chris Sides recently mentioned the “love-bombing” launch strategy, but this isn’t the answer. The industry needs a framework for testing demand before committing millions more to development. Mobile gaming solved this riddle years ago; 2025 must be the year HD catches up.