7 Things Squad Busters Needs to Experiment with NOW

May 17, 2025

The game needs to go crazier. If game development aligns with an explore-exploit model, Squad Busters must continue exploring. That means covering as much exploration space as possible. Eric Seufert makes similar claims in UA creative testing, and those lessons apply similarly to games. The changes from 2.0 were big, but they need to be bigger.

- Deck Loadout Everywhere

Due to short mobile session times, there is insufficient time to build depth through in-round progression. Marvel Snap is a goddamn gift from the CCG gods in this light, and remains the top tier benchmark. Players must be able to theory craft, which rarely happens in real-time. In auto chess, players have specific deployment phases, which is also true for CCGs, MOBAs, and Vampire Survivors. Players also enter with a known strategy.

Squad League gives players this choice, but it’s limited to one game mode and buried in the UX. The experience should focus on building lineups and encouraging a specific playstyle.

- Alliances

Building on autochess mechanics, my blop of units creates unclear strategy readability for me and my opponent. Alliance abilities are granted only when a certain number of units share an alliance trait, improving strategy readability.

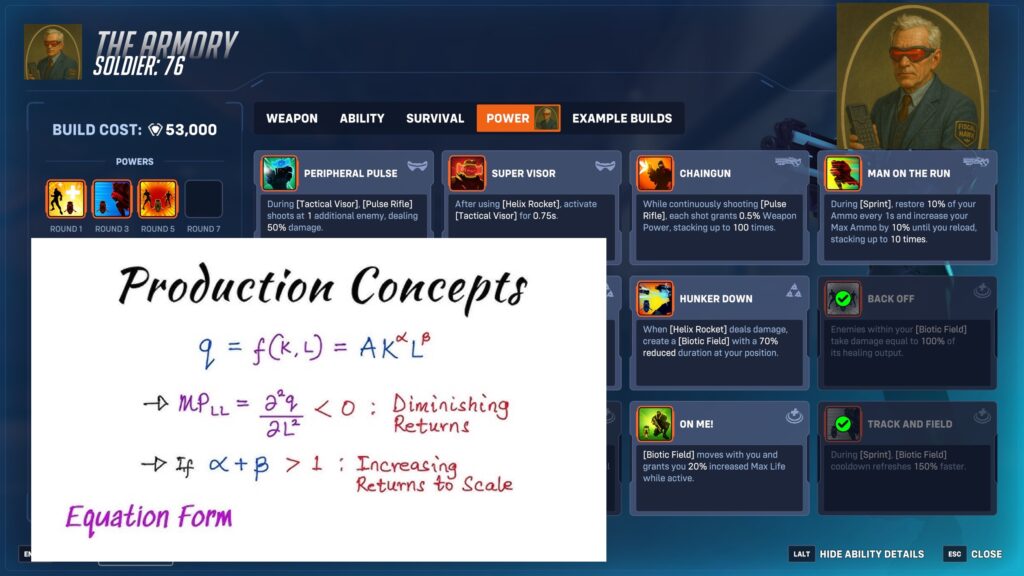

- 70% of squad abilities are conditional passives

The abilities are boring. Heroes and Squaddies need more if/then-type abilities. Players want a match runbook, and maximizing triggers based on specific real-time gameplay patterns adds an enormous layer of depth.

- Squads survive encounters stronger, not weaker.

In Squad Busters, players face off against multiple enemy teams rather than a single enemy. Even after a successful encounter, other players attack as they lick their wounds. This typical play pattern in Apex Legends mirrors packs of wolves (three-man squads) roaming for weakened prey.

This difference is that Apex’s victory over prey means power increases through a leveling system or the dead enemy’s loot. Squad Busters features only a single chest key for defeated enemies and a mad dash for gems that attracts MORE enemy attention.

- Drop Gems or Chests

In Squad Busters, some modes determine ranking by the number of gems players collect from PvE enemies and killed player units. The game also utilizes coins, which can be used to purchase chests that unlock powerful units. It’s too much to manage and too hard to cut one or the other from the herd. Maybe gems automatically level up the Squad (no more chests), or Last Man Standing becomes the default mode.

- Single health bar and improved animation loops

Readability remains a pressing issue, with numerous health bars to monitor. A single bar that’s the sum of all my units ‘ health and my own gives me only two points of focus during combat: my health bar and the enemies. Blinking red units, the death sound effect, or other indicators can still provide more subtle feedback on particular unit status.