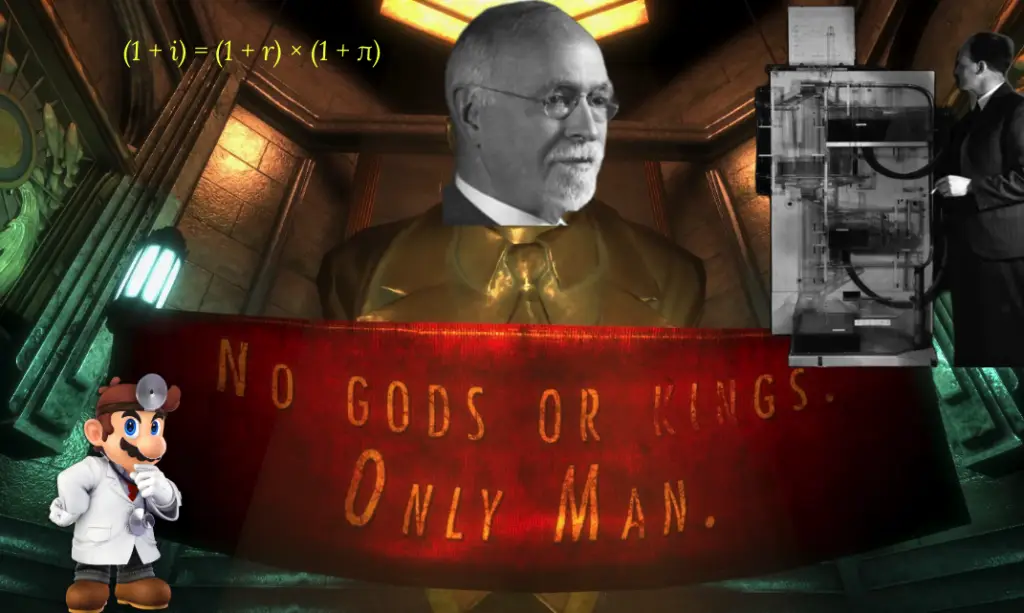

Game economy designers have inadvertently revived the economic traditions of famed economist Irving Fisher. In Fisher’s world, the economy is a hydraulic machine, with refinement or “productive process” occurring as resources flow. The impact of major institutions takes on a literal effect, where a tariff might slow the flow of liquid or capital from one chamber or country to another. It’s a surreal approach and the early attempt at modeling game economies.

Irving Fisher studied monetary theory and price levels at Yale, where his obsession with equilibrium led to an extraordinary invention. In 1891, he unveiled his hydraulic-mechanical computer—a contraption of water, pulleys, and floats that physically demonstrated how prices find their level. The machine, described in his paper “Mathematical Investigations in the Theory of Value and Prices,” became the first working economic model, translating abstract theory into observable mechanics. It was part of a broader effort to formalize economic theory—something game economy design desperately needs.

Tools like Machination and Excel carry Fisher’s torch, albeit in digital form. Machination’s node-based diagrams mirror Fisher’s hydraulic logic: resources pool, flow, and transform through gates and converters. The Excel models do the same, but the piping and transformation process is more opaque (another reason it fails as a tool).

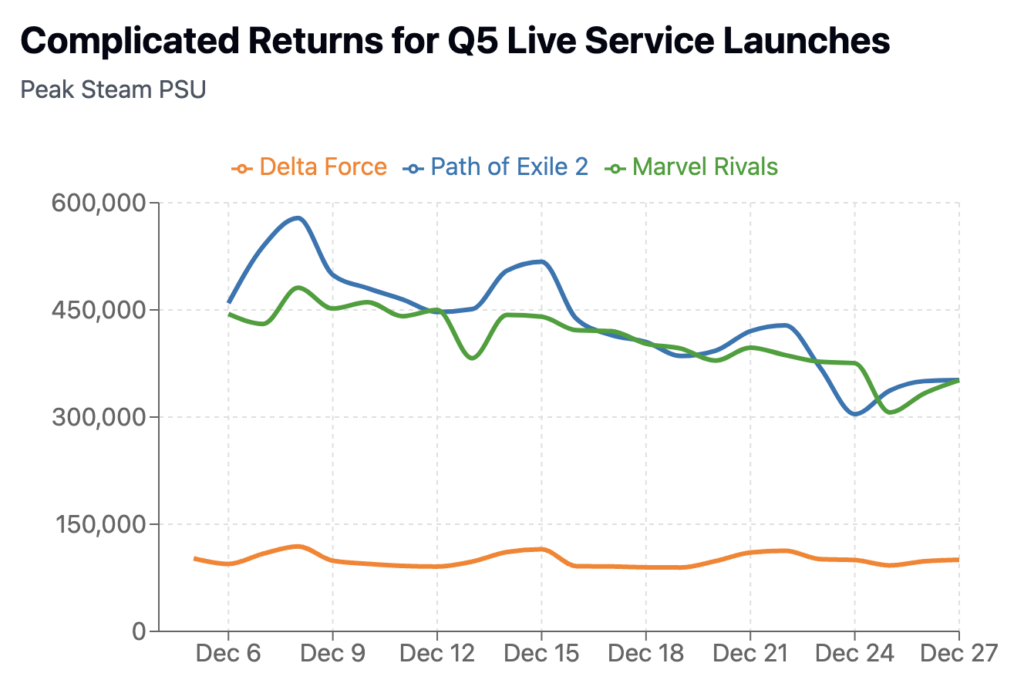

The economy designer is a new role that’s emerged only in the wake of live services played over the course of years. Live services, or long-time horizons, make virtual currency viable for lowering transaction costs (hundreds of IAP transactions mean credit card fees and awkward UX) and crafting complex time/money supply chains. This highlights currencies’ key roles as stores of value and units of accounting.

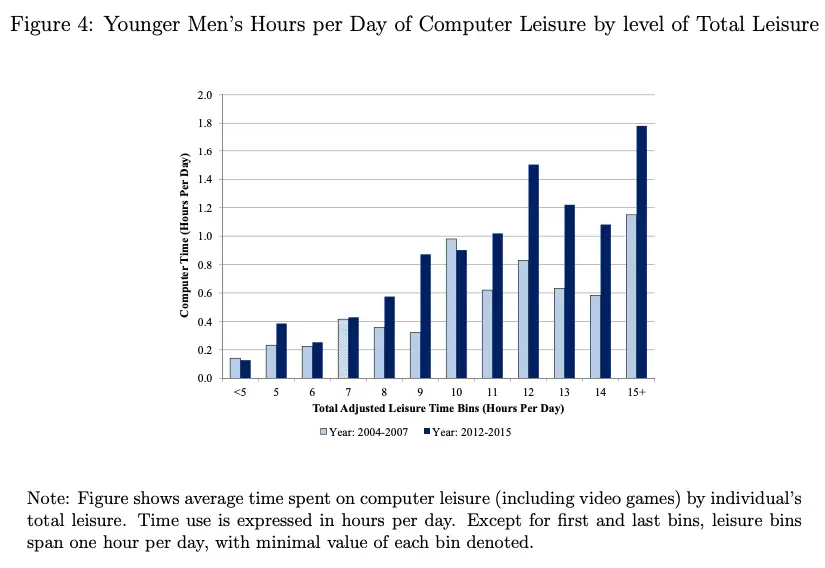

The economic model becomes necessary to understand these time and money supply chains, much as Fisher’s hydraulic computer was necessary to understand price equilibrium. If the only way to understand a supply chain is to solve something down it, then the economy model’s goal is to do just that. The result is an ability to understand unintended consequences between overlapping progression institutions and design the shape of key game KPIs.

The irony of modern game economies lies in their reliance on century-old methodologies. While Fisher’s hydraulic principles find new relevance in persistent digital economies, our tools remain trapped in the past. The field desperately needs reproducible, accessible modeling systems that simplify—rather than replicate—the complexity of modern virtual economies. Reproducibility and accessibility remain elusive, continuing to be the Achilles’ heel of game economy design.