More of the event here, and my talk should be live soon…

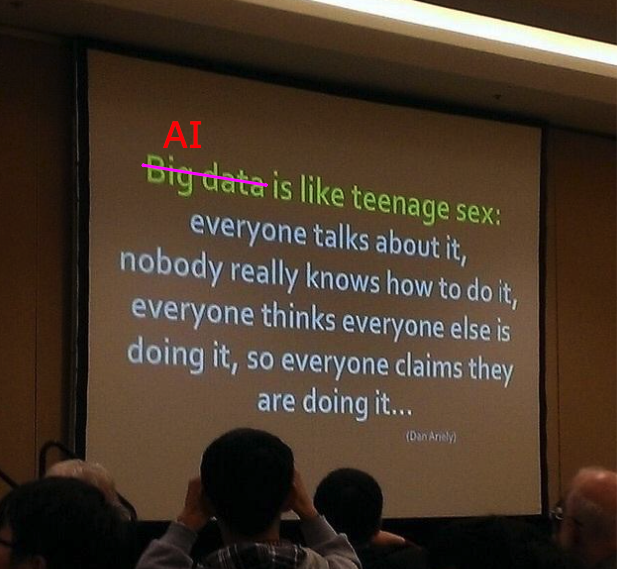

1. Cultural Norms Matter

There’s far less “sharing” in Turkey than in Finland or Sweden. Anyone with a Finnish ID number seems to have access to Supercell’s dashboards! Turkey has largely avoided non-competes, and it must stay that way. King single-handedly has hamstrung Swedish mobile game development with its notorious three-month non-competes, which, after a three-month notice period, amount to six months for an employee to start elsewhere. France is dealing with a similar issue, and it’s to their detriment. Much of Silicon Valley’s success is due to the ban on non-competes, something that’s gone over the heads of subsidy-happy governments.

(more…)