Phil Spencer, Microsoft Gaming CEO, named Johanna Faries the new president of Blizzard, closing a pivotal moment in the ATVI-Microsoft merger. Faries faces the challenge of revitalizing Blizzard amidst declining revenue and engagement across its franchises. The situation is dire enough that Faries inherits a needed rebirth of Blizzard. The Blizzard of old is dead, and several causal agents are responsible.

The Ship of Theseus is a thought experiment about when a ship remains the same after trading its planks one by one with another ship. The same experiment applies to Blizzard, who has replaced a good deal of its workforce after they left for new start-ups. Over the last decade, venture capital siphoned copious amounts of Blizzard employees into new start-ups, aided by California’s law banning non-competes. The VC-backed combination of Dreamhaven (fmr. Blizzard founder), Second Dinner (fmr. Hearthstone team), Magic Soup Games (two fmr. Bizzard Presidents), and Frost Gaint (fmr. Starcraft team) likely have more years of Blizzard experience than Blizzard itself. While sad for Blizzard, like DICE and Bioware departures before it, veterans start new studios, growing the area into a hotbed of talent. Venture capital has made it easy for frustrated employees to take corporate exits.

Blizzard hasn’t been able to use these exits to reset processes and spur live-service growth. Overwatch is sputtering, and mobile growth remains muted. Diablo IV successfully launched but won’t move the needle on long-run monetization, opting for traditional content expansions. Arklight Rumble proved Blizzard could ship quality products and mobile-first monetization, but the lack of mobile UA remains concerning.

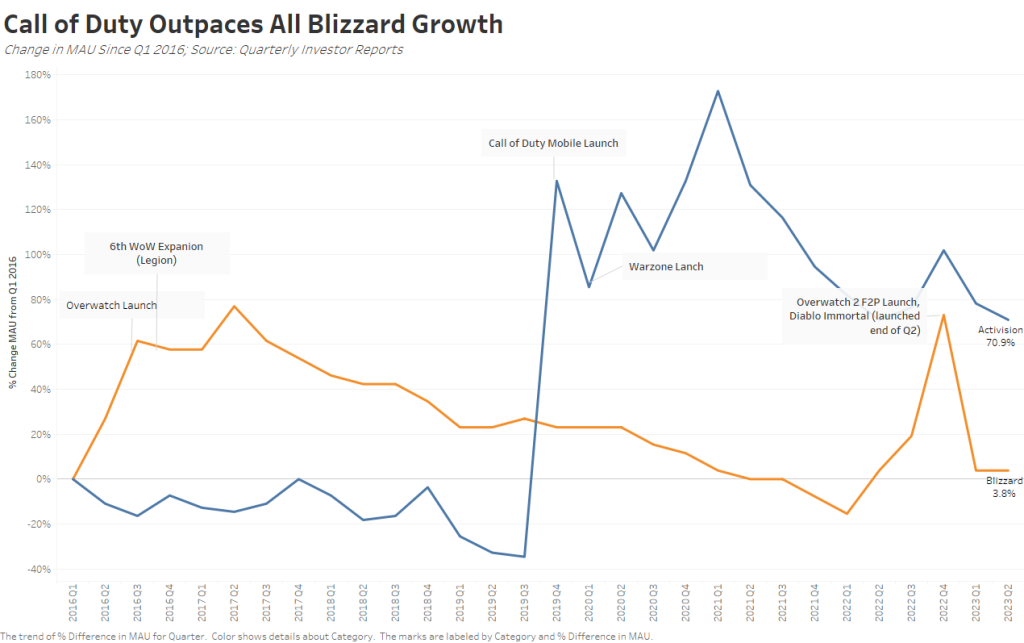

Blizzard’s most damning indictment is the over 50% growth in Call of Duty over the same period. Kotick discovered Call of Duty’s value extended beyond developer Infinity Ward, rotating three studios on the franchise in 3-year dev cycles to hit cascading yearly releases. But much less than “satiate” interest, annual Call of Duty launches made players hungrier for content. Blizzard never exploited economies of scale to maximize franchise value.

While both venture capital and an inability to grow the franchise’s lifetime played a role in pulling the trigger, Blizzard has the opportunity to rebirth itself as a franchise steward of its original IP.

Blizzard’s rebirth should focus on growing existing IP by leveraging studios and headcount outside the Irvine office. Diablo Immortal’s $1B success proves Blizzard PMs can guide eastern development. They can do the same for the Chinese autochess market: a Warcraft alternative to Riot’s top-10 Chinese grossing Team Fight Tactics. The same is true of Overwatch if Valorent Mobile proves to be worth anything. And World of Warcraft Mobile has long been rumored, and with Eastern monetization, it stands a chance at challenging Korean and Chinese MMO titans.