In 1989, political scientist Francis Fukuyama wrote an essay asking if we’ve reached The End of History? Often mischaracterized, the essay argues democracy and free markets represent the last evolution of political-economic systems. Fukuyama writes:

What we may be witnessing is not just the end of the Cold War or the passing of a particular period of post-war history; that is the end point of mankind’s ideological evolution and the universalization of Western liberal democracy as the final form of human government.

Blockchain may well represent game monetization’s End of History.

Following a Kuhnian process, game monetization has been through its own evolutionary process. But by all means, the evolutionary process has not been linear. The transformation from coin arcades, fixed-price titles on-at-home consoles, DLC, and free-to-play has happened in uneven bursts. Lest us not forget, between 1981 and 1984, arcade revenues halved from $8 billion to $4 billion. The saving grace was Nintendo’s 1986 launch of the NES that buoyed an arcade comeback. Not everything is up and to the right. We’ve had unique detours, including per-game subscriptions ala World of Warcraft and a never-ending flirtation with ads in all forms. The last two decades appear to showcase an accelerating rate of change. The time between the launch of the Xbox Live Marketplace (2005) to Farmville (2009) was a mere four years, with Candy Crush launching on mobile two years later, in 2011. Free-to-play has only grown since but hasn’t entirely delivered the finishing blow to fixed-price titles. Instead, the industry has grown; as we know, rising tides lift all boats, so we find different game experiences supported by different models.

However, Kuhn observes the ability of old paradigms to survive if they can integrate the questions posed by new paradigms. Blockchain gaming isn’t about “true ownership” or “decentralization,” which are pseudo-socio-political causes irrelevant to the gamer. What started with the Steam marketplace is crystallized and popularized in blockchain games: markets.

Technology Doesn’t Always Work Backwards

I’ve been particularly hard on “true” ownership, but as the tweet that opened this series opined, something is interesting about blockchain underneath all the craziness. That interesting something has been staring us in the face. If the last year has shown us anything, it’s not just markets; it’s so obviously markets. And not just the video game kind, markets in everything.

Public and open readability of tokenized assets enables the beautiful world of price discovery to bear down on games. It might not be revolutionary, but it’s undoubtedly evolutionary. Yes, individual games can adopt the Steam Marketplace or build their own auction houses as EA has done with FIFA. But doing so is prohibitively expensive and fraught with cross-platform complications. Asking, “what can blockchain do that normal games cannot?” is not a particularly useful or informative question. It’s the sort of question your parents asked when you desperately argued for them to drop sending snail mail in favor of emails. Or perhaps we can revisit naysayers suggesting the iPad is just a larger iPhone. And yet, the iPad is precisely that. I’m not sure Apple planned for the iPad to become check-in machines at workplaces or cash registers at coffee shops.

Instead, it’s useful to ask, “What does blockchain make cheaper or easier than alternatives?.” There’s room for faster horses just as much as cars.

Little developer action is required to enable on-chain assets to list on OpenSea or Mintable. The public readability of blockchain allows for multi-homing across various marketplaces. Making a token or minting a new on-chain asset for auction is surprisingly easy. The technology is there, but the design, cultural resistance, and lack of internal corporate advocates have hampered auction houses from advancing sans blockchain; gaming has a bizarre relationship with player-to-player trade.

Everquest, MMOs, and Something, Something Diablo

The vast majority of games operate under autarky or near monopoly-monopsony relationships, the paradigm we’re operating under when buying and selling items in most RPGs. But beginning with Everquest (1996), MMORPGs carved out a small genre expectation that has run for decades. MMORPGs provide a natural genre-feature fit; markets are particularly useful when participants have a range of comparative advantages. As we know, MMOs enable everything from fishing to chopping wood. Auction houses never became a do-or-die feature despite on-paper justification as an engagement mechanic. For example, it took Runescape as much as three years after its launch in 2007 to implement one.

The existing MMO markets traded in virtual currencies; participants could only spend currency earned via in-game activities to purchase items. Diablo III provided a mainstream break away from this model; players could sell items for real money.

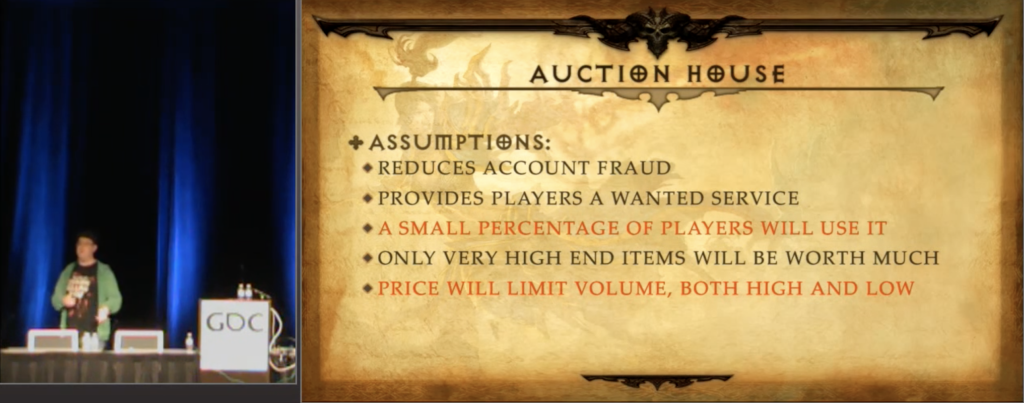

Nearly every conversation about auction houses mentions Diablo III in passing. The comments’ substance amounts to, “auction houses are interesting, but Diablo III’s failed.” It’s become something of an academic exercise to point this out. And while Blizzard did remove both the real and virtual money auction houses from Diablo III, they were far from a failure. Conversely, they were a smashing success. 50% of players regularly engaged with the auction house (!), with some players bringing in enough to supplement full-time incomes. Sound familiar? Jay Wilson, Diablo’s game director, further conceded the auction house performed as intended to combat account fraud.

Diablo II revealed players were already trading items but doing so off-platform, resulting in scams (repeated in World of Warcraft, mind you). Given all this, why kill the auction houses? Blizzard didn’t want to sell progression.1

Over the years, I’ve spoken to designers from the Diablo team, and I’ll immediately ask about the auction house. While stories differ and memories are hazy, there’s repeated mention it caused quite a bit of strife on the design team. “No feature is worth breaking up the band for,” a designer recalled. Fair enough, considering Diablo III is one of the best-selling games of all time. Looking back, it’s a very early-2000 design philosophy and quite silly considering what we now know.

Valve and the Auction House Gap

Essentially a research institution, Valve is always lightyears ahead of current industry thinking, whether in battle pass, VR, or auction houses. It’s worth pausing and considering Blizzard announced the auction house in late 2011, while Valve launched the Steam marketplace only a year later, in 2012. And, of course, Gabe contacted Yaris before Valve launched the marketplace.

Similar to battle pass, we can capture the value of marketplaces in a couple of different ways. For the post’s purposes, let’s consider strictly firms rather than players. A simple way to consider auction house value to the firm is as the difference between auction house price and the next best pricing scheme:

Over and over, we’ve seen just how glaring this difference is. What developer would know to price an item at $10,000? The more significant the gap, the more auction houses make sense. The advent of live service games is growing this gap the previously unimaginable heights.

Lifetime Utility

When players engage with a giver game measured in years rather than days, time horizons shift. Game assets are fixed upfront fees that provide a stream of benefits over time; the longer the time, the bigger the net present value of the dividend. From Game Companies Are Not Tech Companies IV:

The efficiency of any monetization or pricing system is the degree to which it can correlate marginal cost (MC) to marginal benefit (MB). In the above examples, we fixed the price. Fixing the price makes sense, given that the utility curves flattened out. But the more the curve refuses to flatten, the most decorrelated MC to MB becomes as Time continues.

The 140 character history of game monetization is a cat and mouse game between the ability of games to grow LTU and pricing mechanics trying to catch up and appropriately price those LTU gains. Auction houses represent the final form of this cat-and-mouse game. Prices can automatically adjust to increases (or decreases!) in the value of in-game assets. In-game assets, however, only cover part of the transformation. Sitting adjacent to auction houses is the ability to invest games directly via tokens—to be discussed in a future post.

Blockchain is making a real play to bring markets in games to the mainstream; whether or not the feature survives in strictly blockchain form remains to be seen.

- There’s a claim it dropped player numbers, yet I haven’t seen any evidence to back this up