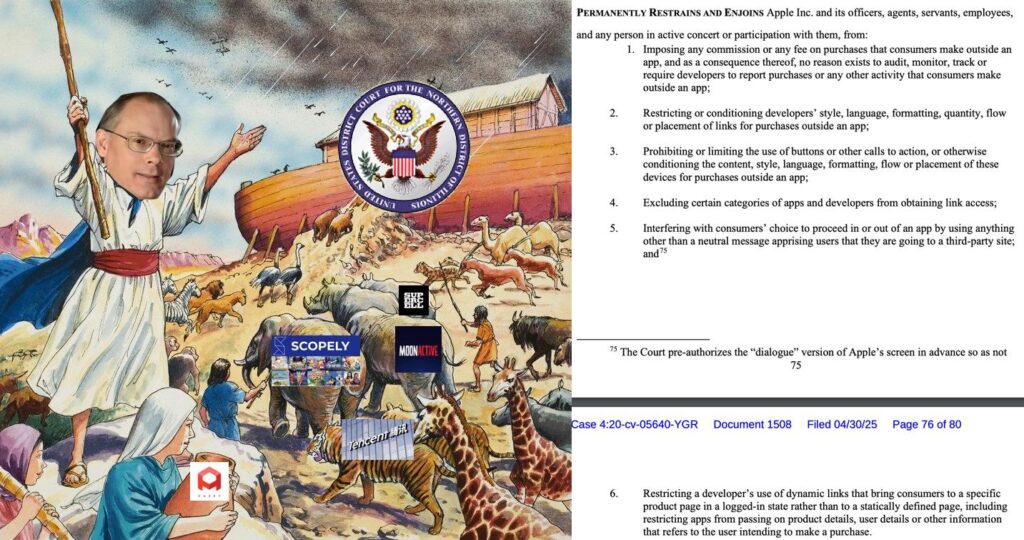

Pokémon’s patent of spherical objects throwing of cartoon creatures threatens Palword’s lifeblood, while Tim Sweeney has lifted, at least a percentage point, in total gaming GDP with its injunction success.

- How does Apple’s rent-seeking rate change in the face of this ruling?

- Should Apple lower its rate to 15%, like it did in subscriptions?

- Remember, it faced competition primarily from “webstores” too.

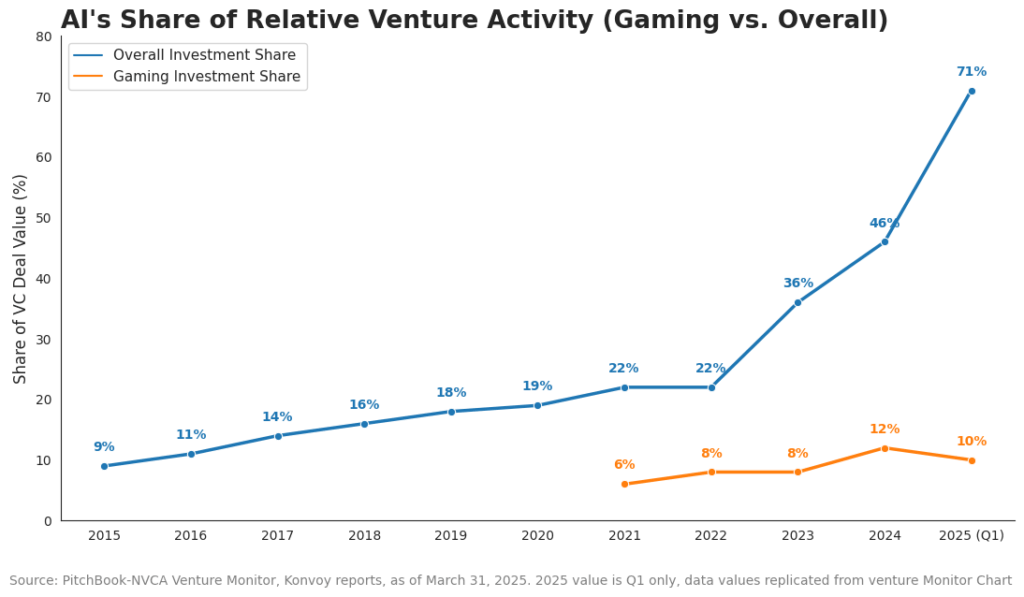

We premier a new segment: SOLVE that for EQUILIBRIUM. We discuss the marginal monetization effects and debate the benefits of personalization opportunities (hint: there are none) with webstores. @Chris is intrigued by Joost’s piece on rising game costs, while AI’s effects on the industry are measured in the Solow model. @Phil insists rising game costs mean rising revenue and stable margins, while Eric has his own doubts.