Digest or Die: Tripledot’s Big Gamble

Tripledot’s nearly $1B acquisition of Applovin’s studio collection appears to be a massive and leveraged gamble but reflects the shrinking pool of the hyper-to-hybrid publisher game of musical chairs. With the stroke of a pen, Tripledot’s revenue portfolio radically shifts from 1% IAP to being a majority. Meanwhile, Voodoo, Homa, and others undergo painful and slow transitions in hybrid-style games, with success stories like All In Hole taking over two years to release after Attack Hole’s 2022 release. Rather than incremental growth, Tripledot bet on transformative integration in one dramatic move. While there’s massive operational risk, if Tripledot can digest Applovin’s studio collection, the product will be larger than the sum of its new parts.

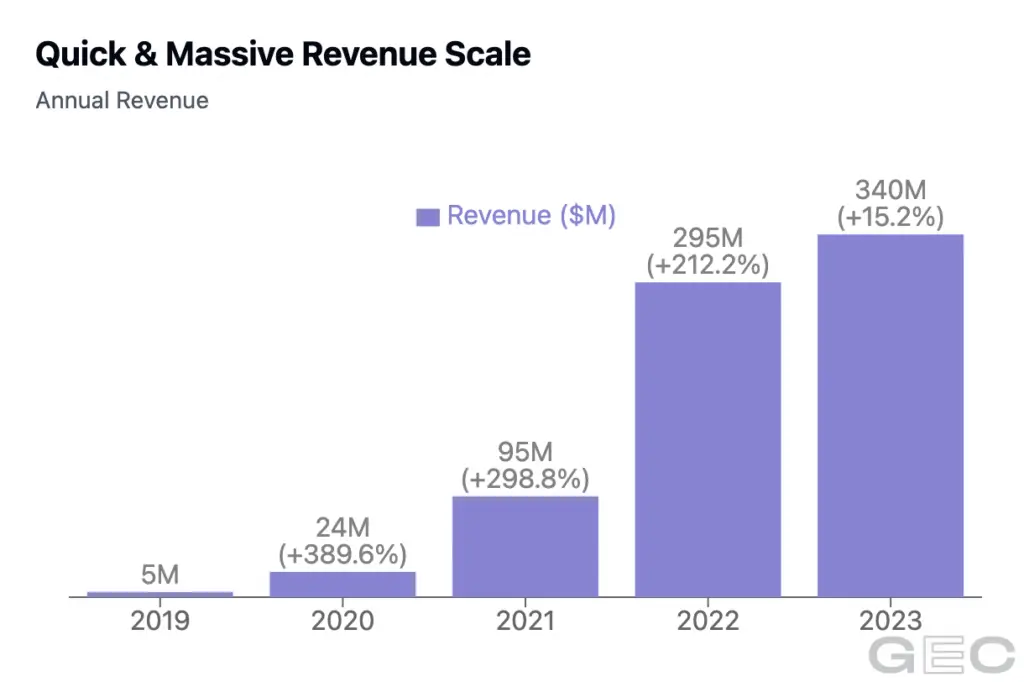

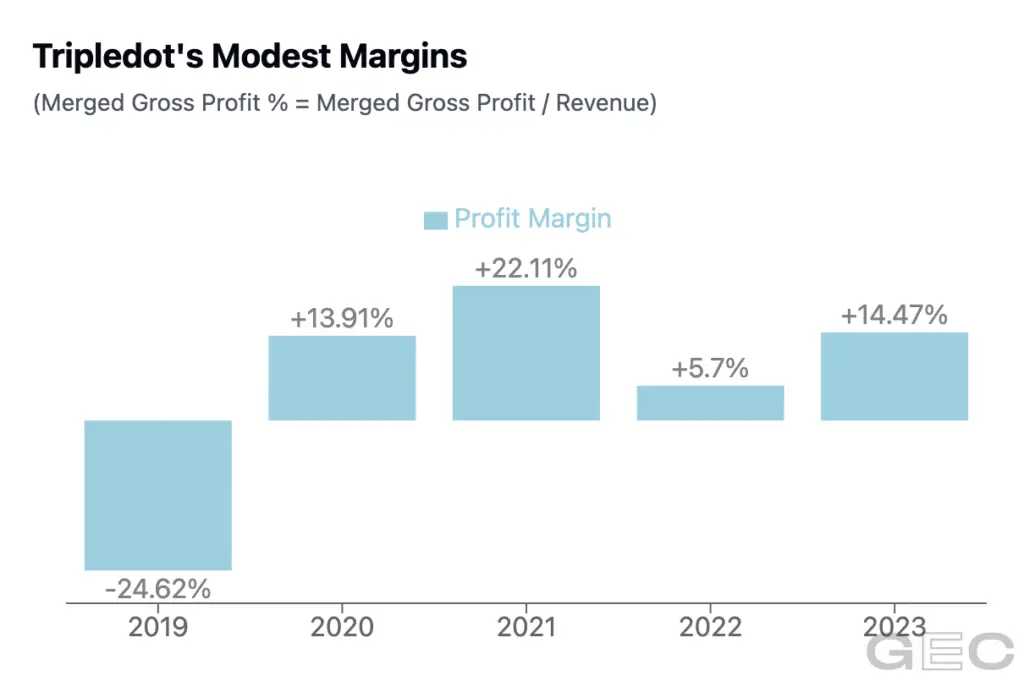

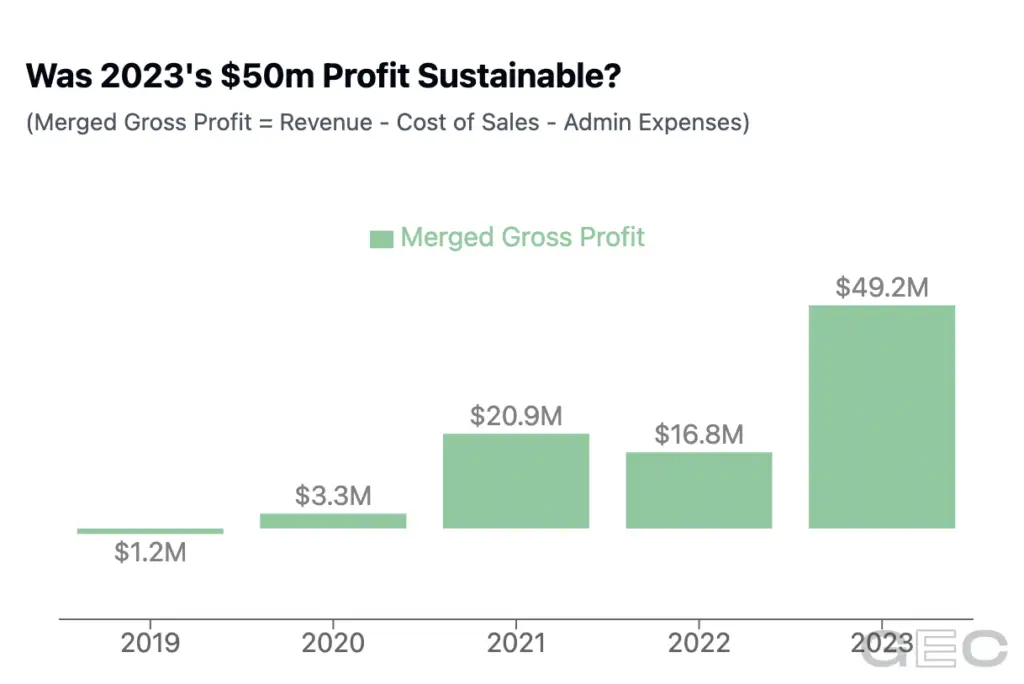

Tripledot’s filings reveal an astounding 98% ad revenue share, which brought in over $300M last year. Yet margins languished around a frustrating 15%, underscoring why the rush toward IAP and hybridcasual feels more like a strategic necessity—aimed at gaining leverage over spiraling acquisition costs and boosting future valuations. Again, gaming economics resist easy analogies and maintain diverging economics from traditional software or subscription models like Netflix (35% margins, pricing power, fixed costs!).

Eric Seufert’s recent “Economics of Mobile Gaming” underscores how essential ads remain for value distribution within the mobile gaming ecosystem. Titles employing a “fakeout” strategy, such as Last War, Frozen City, and Top Girl, edge toward vertical integration, directly integrating the value routing system into the game. It’s a tangible opportunity for Tripledot, with surprisingly few Western attempts. Where are the Star Trek Fleet Command fakeout funnels? Machine Zone, with its expensive-to-develop 4x engine, offers intriguing potential if Tripledot can duct tape something hypercasual on top.

Applovin’s robust social casino segment (25-30% revenue) presents fewer exciting opportunities. Project Makeover, contributing a substantial 15-20% to Applovin’s studio revenue from IAP, has already leveraged aggressive ad creative. While Applovin’s genre diversity may appear hedged, it’s more of a management headache, as its genres maintain domain-specific knowledge. Other suitors like Scopely likely passed on acquiring these studios due to similar management complexities, a factor evident in their selling price – a sub 1x premium over the studio’s annual revenue.

Typically, acquirers streamline headcount aggressively; however, in this scenario, cuts risk losing critical knowledge in nuanced genres like 4x, social casino, and survival. As Zynga demonstrates, structured performance payouts or golden handcuff arrangements are prudent for revenue stability.

With $300M in cash assets, Tripledot’s leveraged acquisition strategy involves assimilating studios with higher revenues and larger headcounts alongside significantly different business models. Despite impressive revenue, Tripledot’s growth trajectory showed signs of plateauing, and looming EU regulatory uncertainties complicate prospects for its ad-centric revenue model. Digesting this complex asset carries significant risk—failure could prove catastrophic—yet avoiding such aggressive moves risks an equally painful hyper-to-hybrid transition.