I have a lot to say about Marvel Snap; it’s a breath of fresh air in a mobile market that’s smelt stale for too long. Snap dedicates itself to taking advantage of mobile rather than treating it as a tax. However, for all its innovations and wins, I wonder if the Snap team outsmarted itself with a monetization model that will cap its success.

Despite structural issues, Snap isn’t far from snapping a top 20 revenue spot. But beyond the dizzying amount of design innovation and truly outstanding animation work lies a monetization system so soft it makes marshmallows blush. Instead of glaring at Hearthstone or MtG Arena (~$300m – $600M per year), Snap should set its revenue sights higher to Clash Royale’s glory years (~$700M). At ~1.5M DAU, this suggests a $1.27 ARPDAU target. That’s an extremely tall order that requires moving both the numerator and denominator.

With so much to celebrate and discuss, I split covering Marvel Snap into three parts: Game Overview + Game Economy & Monetization, Progression + LiveOps, and UX. Here I cover Game Overview + Game Economy & Monetization.

Context

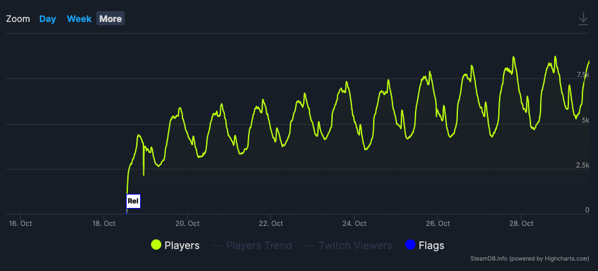

At the start of 2018, Ben Brode and Hamilton Chu packed up and left Blizzard after more than a decade each to start Second Dinner. After ~4 years of development and ~6 months in soft launch, the former Hearthstone Design Director and Executive Producer finally released Marvel Snap in Oct 2022. The Collectable Card Game (CCG) has already amassed a whopping 6m+ downloads with publisher ByteDance (see: China expansion and license), while the game’s apparent “stacking DAU” is an encouraging sign. While mobile engagement is tricky to track, Steam actuals suggest ~100k DAU against a PSU of ~8k. It won’t surprise me if Snap has already surpassed 1.5M DAUs between PC and mobile platforms. It’s probably a sign of the massive uplift developers get from macOS development. It’s a great start and suggests an extremely bright future for Second Dinner while encompassing everything Blizzard mobile should have been and will likely never become.

Marvel Snap’s Early DAU Stacking (Steam)

Game Overview

Improving lane-based play isn’t the only mechanic Snap weaves throughout its design, drawing from retreat mechanics in Air, Land, and Sea, card design from Marvel Smash Up, and session time learnings from Valve’s recent failure Artifact. Nearly every design, technical, and UX decision is presented to the alter of session time. The adherence to the mobile medium is a heavy pivot from a Hearthstone team whose past mobile releases haven’t exactly won player applause. And despite Ben Brode claiming Marvel Snap represents all he knows about CCGs, it’s also an exemplary understanding of what he appears to know about the mobile and digital medium.

Marvel Smash Up Card Design

The Need, The Need for Speed

After the massive success of Clash Royale, there was a flood of speculation that real-time mobile PVP was the next great mobile design paradigm. However, real-time PVP has barely evolved since Royale’s launch six years ago. And, in the handful of successful cases, it’s come from HD, not mobile franchises, like Fortnite, Call of Duty, and Apex. Even synchronous CCGs like MtG Arena and Hearthstone are hardly considered “mobile-first” titles, and I suspect their revenue splits endorse that view.

The critical difference between Marvel Snap and others is that Snap designers didn’t sit down to make a great CCG; they sat down to make a great mobile digital CCG. The game’s marketing frequently refers to the speed of play, and perhaps even the game’s title is meant to be a play on speed (over in a Snap?). So many choices are geared toward reducing average match time:

- Players play simultaneously rather than in turns

- Match time has an upper limit enforced by:

- Turn time is capped at 40 seconds (Hearthstone clocks in at 75 seconds)

- 6-turn limit

- A “Snap” mechanic which encourages players to retreat before turn six

- This reduces average match turns to ~ five turns, shaving more match time

- Three rather than seven-card opening hand reduces decision space in early turns and aids speed of play (I’m unsure why they don’t shorten the early turn timers).

- No ability to mulligan

The UX gets credit here too:

- Ultra-fast matchmaking (3 seconds or less)

- Vertical, rather than horizontal presentation (how users naturally hold phones)

- Snappy animation

Some handy APIs and curious players help us compare match parameters across CCGs; here, the comparison inches Snap closer to Clash.

Match Time Parameters

| Title | Average Match Time | Maximum Match Time | Average Match Turns | Maximum Turns |

| MtG Arena[1] | ~13 min | 60 min | 6.7 Turns | 53 Turns |

| Hearthstone[1][2] | ~6 min | 60 hr | 9 Turns | 89 Turns |

| Clash Royale | < 3 min | 3 min | NA | NA |

| Marvel Snap | < 3 min | 4 min | 5.5 Turns | 6 Turns |

Just Card Design Things

In nearly every card game, physical or digital, players fiddle with their in-hand cards, rearranging them in some particular order. It functions as an itch, the equivalent of a walk-up routine in baseball.

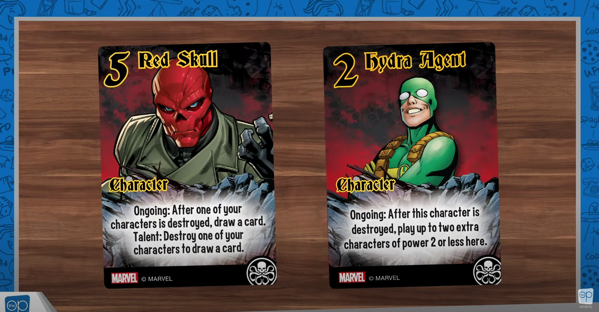

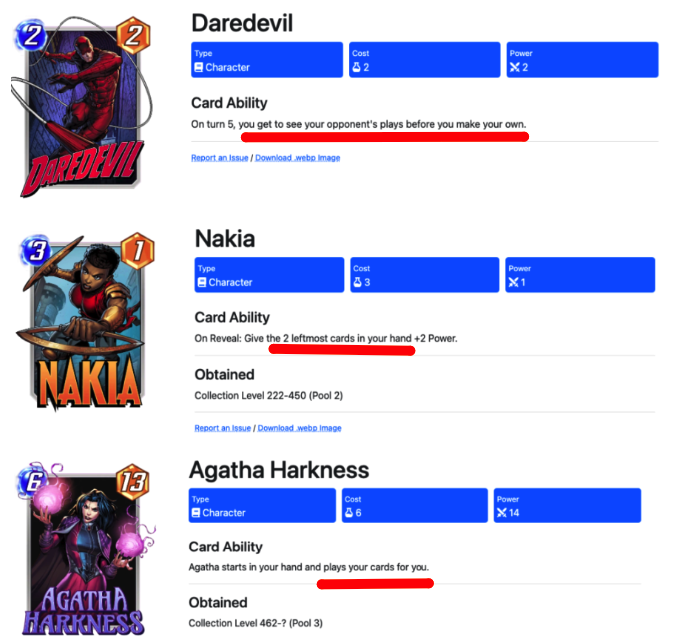

But Marvel Snap prevents players from arranging and rearranging card order in hand. I pondered why only to come across a card whose effect is to enhance the power of your leftmost cards. With the ability of players to change hand order, players could guarantee the card effect pairs with the best in-hand cards.

Consider another card, Daredevil, which lets you “see your opponent’s plays before you make your own” in a simultaneous play card game. Or there’s Agatha Harkness, which plays your turns for you. Yes, you read that right. There’s simply nothing Second Dinner card designers won’t mine for a mechanic, and they fully take advantage of the digital format possibilities in a way Magic is only starting to. It can feel like Second Dinner designers are rummaging the proverbial mechanic couch for pennies only to come up with twenties. I don’t know if this is a stable design foundation for a 10-year game, but it sure as hell is a fun one. I feel like I’m problem-solving in real-time with weird and exotic tools that surprise and delight. However, I suspect set-based mode restrictions will appear sooner rather than later.

Can card design be too fun? No, no, it can’t.

Naturally, the other design table stakes are improved. For example, a single card apparently solves the mulligan mechanic. Limited lane space is consistently played up as a mechanic. Card effects may destroy other cards in your lane, manifesting as positive and negative effects. “Opening up lane space” lets powerful cards take the place of weaker cards. The game’s lane events (revealed in each of the first three turns) layer a liveops mechanic on top of a Texas Hold’em Poker flop. The game’s limited turn count reduces the need for large decks; instead of 40 or 60 cards, players only need twelve single-card copies (no duplicates) to field a deck. It translates to less “draw screw” as players draw ~75% (9/12 cards) of their decks every game after considering starting hand size and turns limit. It’s also here monetization, and progression problems begin to rear their head.

Game Economy and Monetization

While Snap needs tailor-made monetization choices to pair with its peculiar design, I think the team outsmarted itself.

Snap will be (and already is) plenty successful, but every parent wants to see their kids reach their maximum potential, and game development is closer to raising kids than you might expect. Growing monetization into all it can be is a part of a game’s “flourishing.” A closer mirroring of the Clash Royale meta, more robust sharding implementation, and a drafting feature would drive ample revenue and sound ethics.

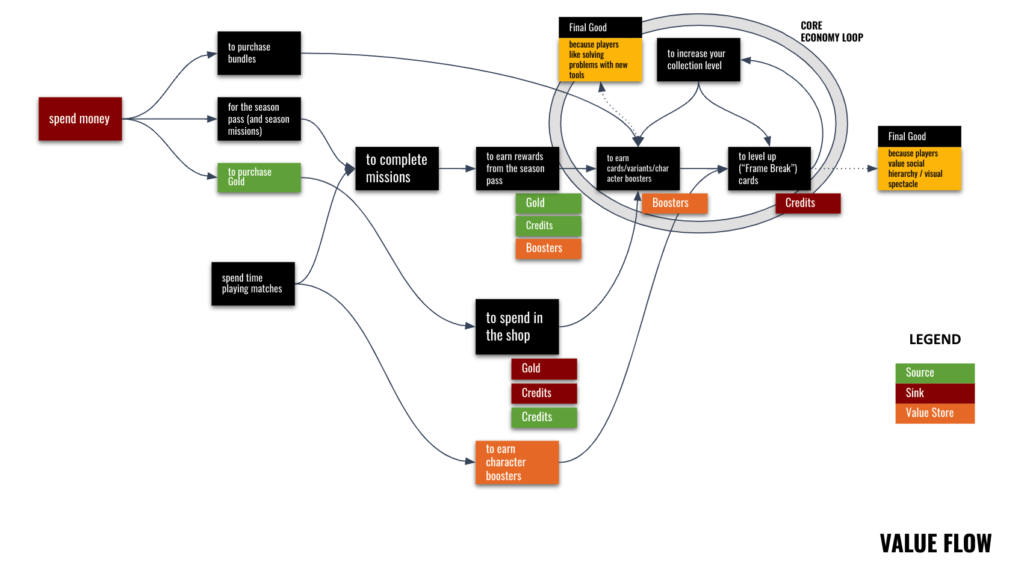

Game Economy

Players who want new cards receive them from…purchasing card packs? No! Instead, players increase their “collection level” by “frame-breaking”; spending “credits,” and a randomly distributed card-specific XP called “boosters,” to upgrade cards cosmetically. Completing frame breaks reward collection level points, which in turn, unlocks new cards, variants, and boosters. Players purchase gold which may buy a daily limit (!!!) of credits or cosmetic card variants. What I’d call the core economy loop revolves around collecting materials for frame breaking, frame-breaking, and unlocking new cards via collection level (which function as more material for frame breaking).

Value Flow

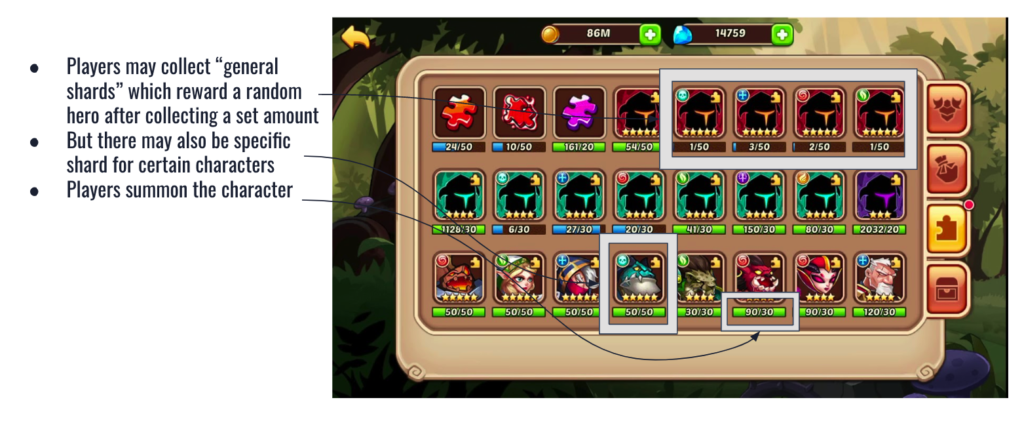

The Value Flow catalogs a bizarre way to pretend not to sell horizontal gameplay. It feels as if a misplaced sense of ethics encourages Snap to contort its design into a Reed Richards-esque figure instead of simply using card packs to distribute new cards. Instead, players are 5-6 hackneyed steps removed from USD, translating to new cards. In a more Royale or even aRPG model, randomly distributed boosters from packs would “fill” a given card until the player has collected enough shards to unlock that card. Sharding still allows developers to implement controlled RNG into unlocks as well. Here’s an example from Idle Heroes.

Snap essentially does this for boosters and frame breaks, but sharding should be expanded to new card acquisition. Instead, the team implemented high-stakes loot box special events at ~$300 per new card. Assuming Second Dinner was planning on time-based price discrimination, I don’t think they got the price wrong, just the distribution. Apex Legends faced similar initial battle pass criticism, but the issue wasn’t over the pass itself, but rather the difficulty (and thus implicit price). While diagnosing between structural and systems design problems is no easy task, I think the Snap team threw the baby out with the bathwater.

Structural or Systems Problem?

Sharding helps modularize and marginally distribute large single-value durable goods (you have it or you don’t). This is crucial for a game with 12-card single-card-copy decks, 80% less than Magic the Gathering. The nth+1 card value, where n is deck size, drops off dramatically. Players want to maximize the collection of those who take the field, not those who sit on the bench, and large deck sizes encourage players to chase a wide array of cards.

Growing monetization into all it can be is a part of a game’s “flourishing.” But design decisions made to avoid Reddit’s wrath and “fit in” with low-level Youtubers feels like Lindsey Lohan showing up with an oversized polo to loiter with the Mean Girls at the local mall. Community really does lead us astray, and it’s high time developers, and publishers stop confusing “community” with social media. A game’s community is anyone who plays the game, not just internet commenters. Devs, if the subreddit to our game is an open tab in Chrome, we are Lindsey at the mall!

Was Second Dinner so afraid of loot box comparisons they purposely worsened the booster experience? “Booster” packs are there for the taking! The lack of box/pack animations or UX feels odd for a game dripping in production value. And it’s only animation that separates random end-of-match booster rewards and caches from loot boxes or card packs. Adding pack opening animation helps further player understanding instead of an abrupt end-of-round flow, which doesn’t communicate or excite the player about which card will be selected for booster rewards.

Vertical Progression Isn’t Possible

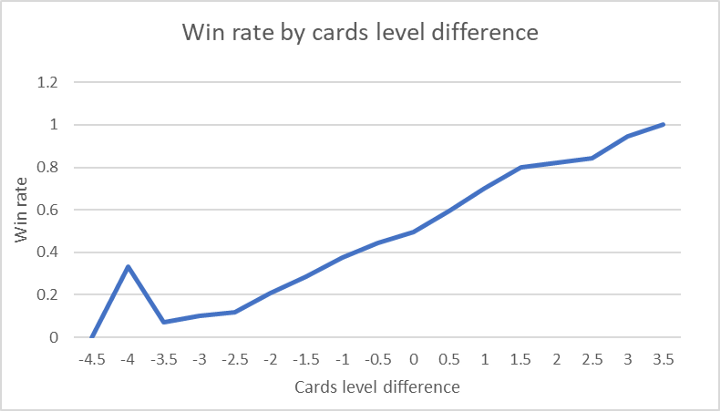

It’s worth reflecting on why Clash Royale’s model wouldn’t directly translate to Snap. Clash breaks from traditional TCGs with “pareto efficient” upgradable cards; increasing a card’s level increases card stats with no adverse effects. A card’s level presents a massive swing in win probability.

This option is barred for Snap: cards don’t have RPG mechanics like health or armor to use in micro-dosing vertical power, and the card abilities are too carefully designed to absorb a radical re-balancing of card power between every player. Sorry, Deconstruter of Fun crew, this one doesn’t make design sense.

Cosmetics

I’ve written about cosmetics before, so I won’t say much more about Snap’s cosmetics system. It’s worth adding that frame breaking isn’t a cosmetic system as it is a cost-saving mechanic to fuel progression. It’s also curious to see Snap break from every other CCG in not building gameplay-related rarity into cards, which we’ll return to in the next post. The real cosmetics come from card variants, but so far, these feel flat with no vertical differentiation beyond a change in 2D art. This isn’t enough. Variants need meta-collection progression layers on top of variations in logos, animations, etc. Second Dinner must massively up its game if they want cosmetics to form Snap’s monetization backbone.

The roadmap appears to deliver on this, but it’s odd to see Snap drop both frame-breaking and rarity for features like Titles and Card Sleeves. It’s also another area that would benefit from more robust sharding. Second Dinner still gets credit for expanding the total monetizable surface with these horizontal cosmetics. Watching every other CCG fumble with player identity and status in a hypercompetitive PvP game has me reminiscing about Shaq’s inability to hit easy free throws. Although, I’m pretty sure no one is hack-a-Shaqing these other titles.

Battle Pass & Store

Instead of card packs, the battle pass does much of the heavy monetization distribution lifting. Let’s apply our trusty ADMC (Average Daily Monetization Cap) model to Snap. And low and behold, Snap comes out on top, next to Dota 2.

ADMC

| Game | ADMC | Total Cap | Entry Cost | Tiers | Tier Cost | Pass Length |

|---|---|---|---|---|---|---|

| Fortnite | $1.90 | $160 | $10 | 100 | $1.50 | 84 Days* |

| Valorant | $1.50 | $85 | $10 | 50 | $1.50 | 56 Days |

| Warzone | $2.86 | $160 | $10 | 100 | $1.50 | 56 Days |

| Dota 2 | $6.39 | $1,010 | $10 | 2,000 | $0.50 | 158 Days |

| Marvel Snap | $3.66 | $110 | $10 | 50* | ~$2* | 30 Days |

| 100 HC = $1 | * Does not include “Season Caches.” | * Conversation rates vary with SKU | *12 weeks avg. |

While Snap does offer rewards past tier 50 (notably loot boxes), players cannot purchase them with gold bars. This is a missed opportunity to monetize cache packs and provides a low-PR risk method for Second Dinner to consider in the future.

The decision to price the pass in USD rather than gold avoids giving away a lifetime of rewards for the cost of a single pass. This was good early learning from the soft launch, where passes were sold for gold.

The battle pass sets the expectation cards will not only be included but rewarded at tier 50, helping drive more tier sink and conversion. Prima Facie, the battle pass, rewards a whopping 3500+ credits; we’ll break that into eventual collection levels and cards in the next post.

The limited rotating store is unnecessary; I’ve covered why these models struggle (and under what conditions they succeed) here. Limiting gold to credit conversations to about $5 daily is the only additional monetization crime. I’m sure this resulted from lengthy discussions between product managers and game designers, and it looks like the designers won. My only retort is that the game and players suffer under the credit purchase limit.

Drafting

Consumables drive “topless” monetization caps. All games contain a finite amount of durables, but consumables are repeatedly purchasable. CCGs naturally extend themselves to one of gaming’s great consumables: drafting. Drafting lets player challenge their problem-solving skills by having them assemble a deck of cards from random pool cards and requires that every opponent do the same. Drafting rarely concerns durable rewards and provides a unique problem test of wit, creativity, and on-the-fly system thinking.

Novel additions like Magic’s designer-driven Cube drafts also wrap a LiveOps opportunity inside an engagement mechanic inside a monetization mechanic. Snap needs to consider moving drafting to its more immediate future, and its 12 card decks are already optimized for drafting speed. While the lack of launch profile cosmetics is forgivable and perhaps even profitable (moving launch dates represents opportunity cost!), I was surprised to see drafting missing. If loot boxes are the lost cause, drafting provides a more structural solution to boost ARRPU.

Final Grade

Snap made several bizarre choices to avoid selling card packs. And while the horizontal expansion of cosmetics (card sleeves, titles, variants) exceeds comparable CCGs, expanding rarity along these dimensions feels like an easy win. A full embrace of card packs and a more robust version of sharding represent more expensive but higher revenue opportunities. The battle pass delivers as long as a Second Dinner maintains a monthly release schedule. Drafting feels like an engagement, liveops, and monetization trifecta, and I’d love to see it bumped on the roadmap.

The following post will look at Progression + LiveOps with a final post on UX. In the meantime, keep snapping! (On turn one, no less).