Mobile Gaming’s Survival is Married to the U.S. Economy; It Should Ask for A Divorce

If you’re European, you need the U.S. economy to grow. If you’re Canadian, you need the U.S. economy to grow. This sobering reality underscores nearly every Western mobile development hub today: for mobile gaming to grow, the U.S. needs to grow. Although optimistic narratives from developing markets like India and Brazil are abundant, their growth rates still pale compared to the U.S.’s real spending power growth. For the foreseeable future, it’s U.S. or bust in mobile gaming, a reality suggesting mobile gaming doesn’t control its destiny.

Political literature in the early 2000s enthusiastically promoted the BRIC nations (Brazil, Russia, India, and China) as future economic powerhouses. Since then, however, these countries have largely underperformed expectations. Rather than converging with the U.S., the gap has widened, placing America firmly at the center of mobile gaming’s economic stability.

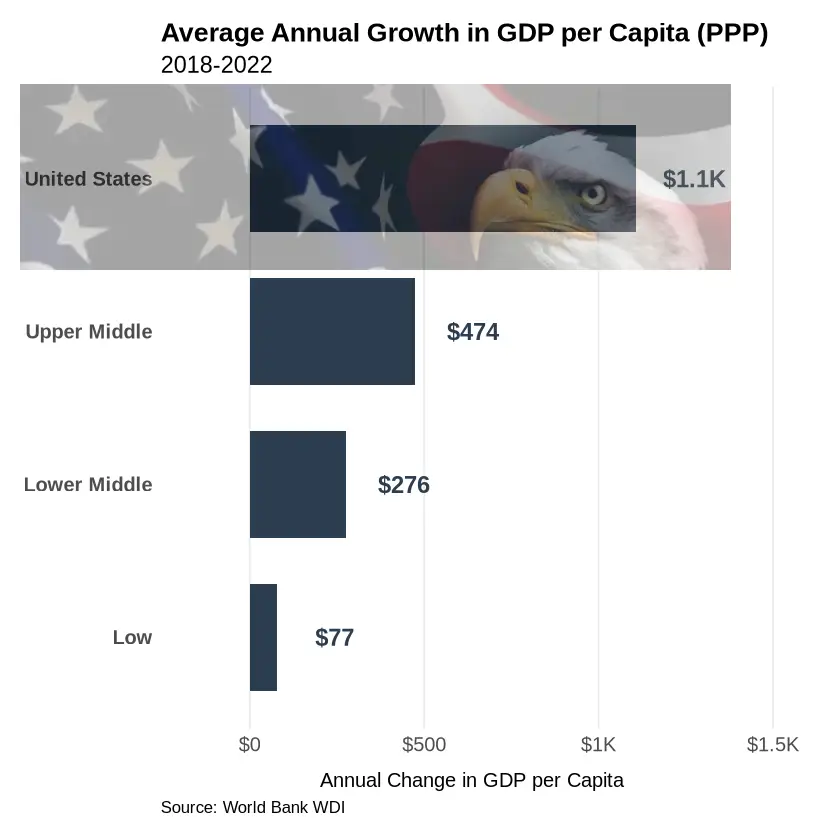

In 2024, the United States accounted for a plurality of global mobile gaming spend, increasing its share by a significant six percentage points to ~35% compared to 2023. While countries like India might boast higher real GDP growth rates—6.5% in 2024—their absolute spending gains remain modest. For instance, India’s per capita purchasing power year-over-year increase was just $400-600, compared to the U.S., adding double that in real purchasing power with less than half the growth rate. While low-income countries have faster growth rates, rich countries have larger real and absolute growth.

Another disparity arises from mobile gaming’s classification as a luxury good (?!): individuals increasingly allocate marginal dollars towards gaming as incomes rise. India’s explosive growth in smartphone penetration—from 30% to 70% in under a decade—hasn’t translated to significant IAP (ads revenue, correlated yet distinct, paints a slightly different picture). Brazil has managed somewhat better, though its monthly IAP spend of $30M remains negligible compared to even markets like Taiwan, which average $150M monthly IAP despite Brazil having 10x the population.

As global population growth slows and smartphone penetration reaches saturation, income growth emerges as the only reliable macroeconomic driver for mobile gaming expansion. Consequently, the United States remains the indispensable anchor for sustained mobile gaming growth until other economies manage a meaningful catch-up.