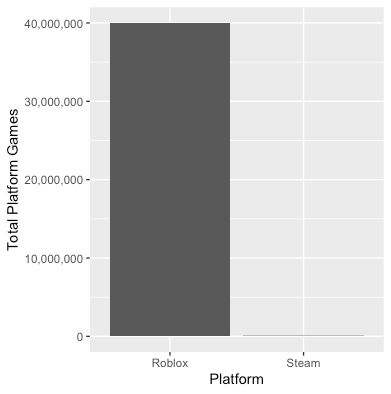

UGC platforms have hailed the rise of the Creator Economy™. Roblox, TikTok, and Youtube have democratized the creation of content, abstracting the costs of getting content to market. But we’ve assumed UGC cuts out content gatekeepers in favor of entrepreneurs. Everyone gets a warm glow when “the little guy wins”. And by all means, this appears to be true! Creators can single handily craft and distribute TikTok videos in seconds, not days or months. The barriers to Roblox creation are higher, but it’s a far cry from the rigamarole of traditional game publishing. The effects of UGC are profound: despite easing requirements with Early Access, Steam hosts 50,000 games to Roblox’s 40 million. It’s such a gap I made this handy chart to underscore the difference:

Total Games by Platform

I wrote in The Content Problem and the Death of Level Designers that content satiation is a defining characteristic of gaming. UGC opens the content furnace to anyone. Yet I’ll argue this equality of opportunity doesn’t imply equality of outcome. The Creator Economy could be the future of consumption, but it isn’t the future of employment. This has implications for how firms payout and develop creator-driven platforms.

Payouts and Superstar Effects

My favorite interview exercise is to estimate the yearly profit of an Uber Driver. It’s unimportant for the candidate to arrive at an accurate estimate. Instead, it’s important to see if the candidate can break down a complex problem into component parts. The conclusion of the exercise underscores the revenue ceiling for drivers. An Uber driver is a rivalrous resource, only one person at a time can consume it. Digital software faces no such constraint. Not only can millions of players play League of Legends at any given time, but the game improves with scale. This isn’t replicated in the case of the 5* Uber driver. High-quality drivers can’t scale beyond ferrying a handful of passengers at a time. It’s the same, for say, barbers. Generally, labor-intensive goods have trouble scaling and are tugged along via Baumol’s cost disease.

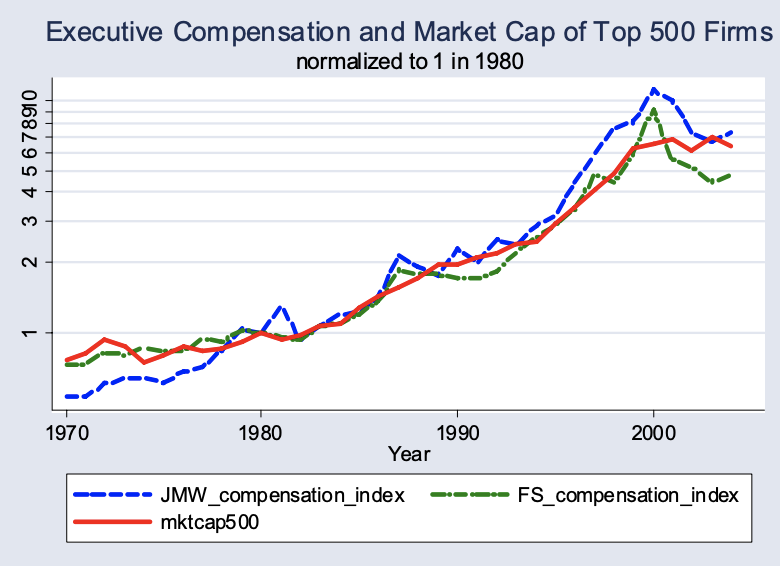

Software unlocks the ability for laborers to scale their labor at near-zero marginal cost. Rosen points out in Economics of Superstars, “…a performer or an author must put out more or less the same effort whether 10 or 1,000 people show up in the audience or buy the book.” Adding, “the implied scale economy of joint consumption allows relatively few sellers to service the entire market. And fewer are needed to serve it the more capable they are.” Empirical evidence points to this as the explanation of why CEO pay has risen so much. Pay ties to firm size and a CEO’s ability to scale their talent across a big revenue function. And which firms have grown to be the biggest? Software firms of course!

Intuitively, it makes sense. A 1% increase in $500m is $5m, while a 1% increase of $50m is only $500k, a 900% difference between the two figures.

Not Many Winners

Economists describe unequal distributions using the Lorenz Curve, and its child the Gini coefficient. A Gini of one suggests a single individual holds all the wealth while a score of zero means everyone has the same amount of wealth. While we don’t have robust Roblox evidence, public data on CS:GO spend helps measure the Gini for F2P products. It’s reasonable to assume Roblox developer revenue faces a similar skew, if not more unequal.

Gini Comparisons

| Country / Firm | Rank (Most Inequality)* | Gini |

|---|---|---|

| CS:GO | .80 – .88 | |

| South Africa | 1 | .63 |

| United States | 54 | .41 |

| Sweden | 142 | .29 |

| World Bank Estimates |

Rex Woodbury, VC and Creator Economy writer, suggested Roblox was minting millionaires:

Roblox is minting teenage millionaires: this year, it will pay out a quarter-billion to its network of 345,000 paid developers.

The S-1 filing from Roblox unravels this notion, only .0000357% of Roblox’s 7m active developers earned $100,000 or more. The 1,000 true fans model is a nice heuristic but it doesn’t appear to meaningfully scale. The theory rests on the diversity of human interests being wide enough to serve numerous and powerful niches. It turns out human interest follows wide buckets. For example, I love first-person shooters as well as World War One history. I should be playing Verdun then, right? While Verdun hits both of these categories, Apex Legends has far stronger shooter mechanics so I choose to play it. The vastness of the Creator economy is governed by the degree of segmentation of interest. The niche interest needs to be strong enough to overcome the benefits of mainstream appeal. How many niche interests can a form of entertainment serve? In the case of Roblox, not many. It’s a tautology to say $10 a month * 1,000 subs equal $100,000 in yearly income, not a prophecy.

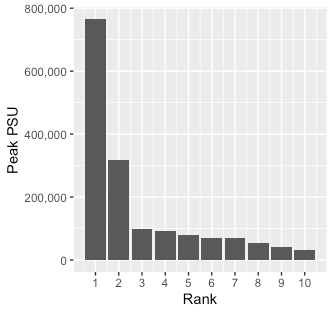

Roblox PR has toured the case of NewFissy, a 50 person studio dedicated to the single Roblox game Adopt Me. But here’s the thing: a 50 person studio seems to be the near ceiling of the platform. The drop between the first and second most popular game on Roblox is stark. Consider the current PSU measures from RTrack:

Roblox Peak Game PSU, May 28th

Both Ran Mo and Rohit describe distributions like these as problematic. I’m less sure if these outcomes are good or bad than I am that they exist. And I don’t believe more platform revenue will spread income to the “tails”. Rising tides of platforms do lift all creators, but they don’t lift all creators equally. In fact, a given Creator’s income growth is probably tied to the Creator’s capture of platform growth. I suspect top Creators capture an increasing share of platform growth over time. Rising tides of platforms do lift all creators, but they don’t lift all creators equally. There’s a difference between saying “everyone can be a creator” and “anyone can be a creator”.

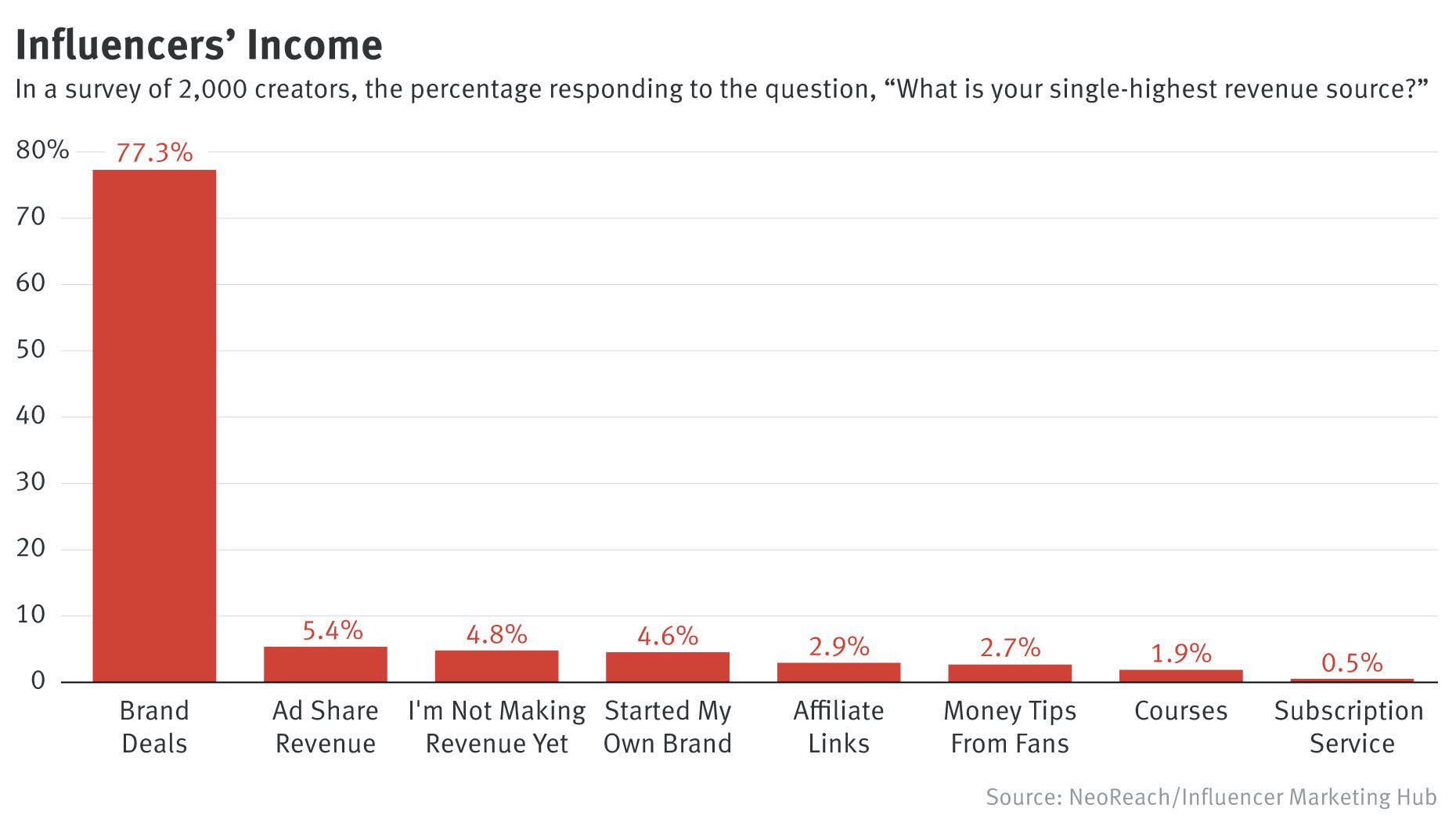

Isreal Kirzner cemented entrepreneurship as the fourth factor of production. And it’s not for everyone. Consider the income composition of Influencers, a unique form of Creator:

Hammering out brand deals is a labor-intensive task! As an alternative to variable income and sweat-based brand deals, Influencers can sign with firms. Firms help centralize and negotiate all these transaction costs. We see something similar on Roblox where freelance contractors have become studio employees. I guess Coase was right. On the other hand, does this make 50+ person game studios like those of Adopt Me part of the “Creator Economy” or just another studio?

Firm Response

UGC lets everyone compete, but it’s not clear it extends the width of the podium rather than the height. Platform earning structure plays a huge role in picking winners and losers. Getting this structure right helps minimize the principal-agent problem. If UGC platforms depend on a few Superstars then programs should be based on finding and cultivating Superstars. It’s not clear to me that “The Creator Economy Needs Fatter Tails“. Does this make billion-dollar creator funds from Snapchat or Tiktok the right approach? As they say, “it’s the incentives stupid”.

Platform payouts need to do two things: (1) tie revenue payouts to platform income and (2) beat creator opportunity cost. Without (1) the platform will lose money in the long run, and without (2) the platform won’t attract any creators. Both of these goals suggest high-stakes competition-based payouts or declining marginal income taxes as platform policy. High-stakes competitions are routinely used for infant UGC platforms, but declining marginal income taxes are less used. The idea is similar to Steam’s new revenue split for publishers – the % share to Valve declines at high revenue amounts. The model incentivizes scale and growth, exactly what we see want to see from Superstars.