The Economics of Game Pass Demand a Playstation Launch

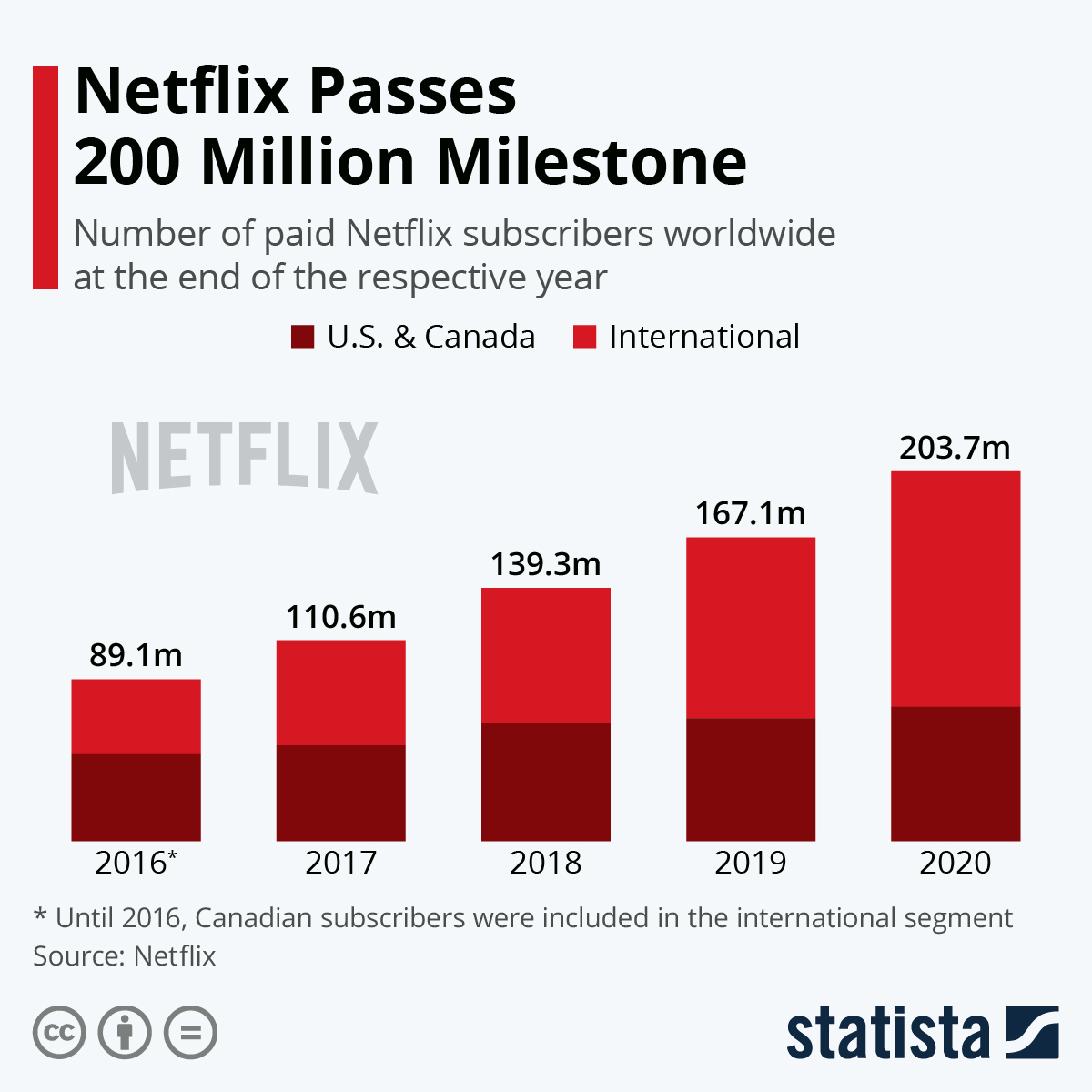

The supply-side economics of subscriptions are fairly straightforward: get massive scale and distribute costs. Netflix has over 160M subscribers meaning a $100M production only costs each user $0.63. There’s zero marginal cost (unlike Spotify), so the more subscribers Netflix has the less a piece of content costs on a per user basis. At $11 per user per month, Netflix can spend over $1.7B on content each month and break even. In fact, as recently as 2019, Netflix does spend close to break even. In the long-run, Netflix has a incredible loop: content brings users, these users lower per user content costs, this accelerates more content spend, which brings more users. Rinse, wash, repeat until diminishing returns take hold.

But remember this wasn’t always the case. Content costs are fixed: the crew of Mindhunter doesn’t care how many subscribers Netflix has. They face costs unrelated to if 100M or 10M people watch the show. As early as 2010, Netflix only had 20M subscribers, suggesting a per user cost of $5 for a $100M production. There’s a gaping hole between $5 per user per $100M production and $0.96 per user per $100M production under their current 160M subscribers. This underscores the massive upfront investment needed for streaming to work on a supply-side basis.

It’s this exact reason Microsoft needs Playstation users for Game Pass to at least have a chance at buying down per user costs. It also explains their aggressive sub & console bundling as well as rock bottom introductory pricing.

Microsoft has disclosed Xbox Live has 90M MAU while Game Pass has 10M MAU. At $10 per user per month, Microsoft has can spend as much as $100M in content per month and break even. Development costs vary widely, but let’s start with assuming a conservative $70M per game. From a break even perspective, that’s around 17 games a year and consistent with Xbox Game Studios current production. That may sound like a lot, but the Xbox One has had over 2,500 games released in its lifecycle or about 350 games a year. Supporting this sort of volume is going to require a lot more users. A lot more.

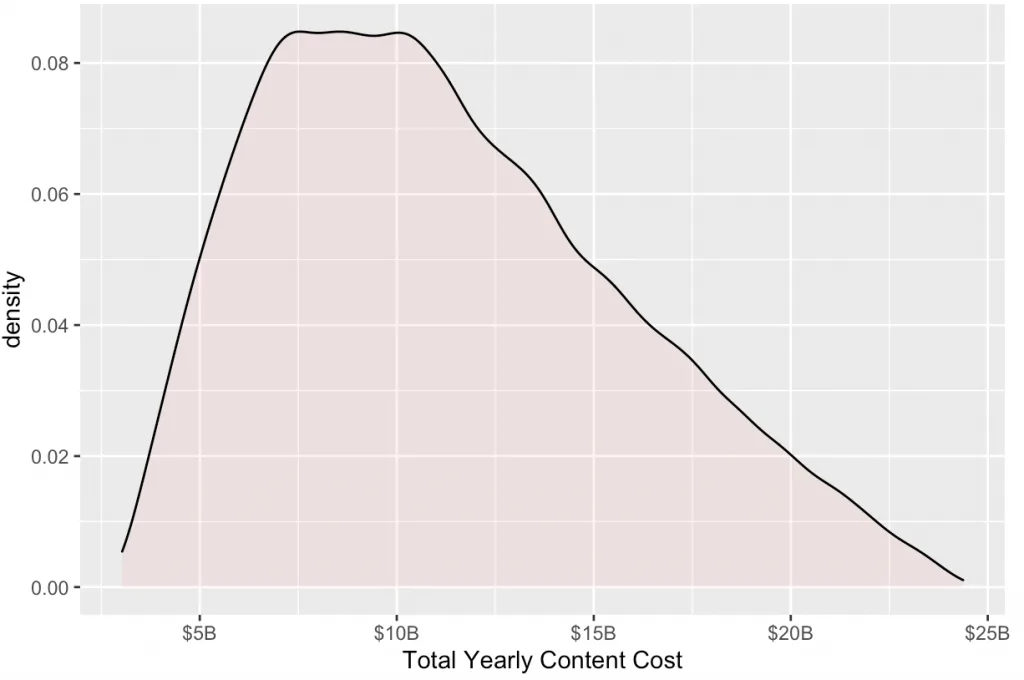

Let’s have a little more fun with the cost side to get a better handle. Consider a simulation assuming anywhere from $30-$70M per game and anywhere from 100-350 games per year. We’ll randomly sample numbers in both ranges, multiplying them together to arrive at a per year content cost (ex: our simulation might pull $40M a game and 125 games for a yearly content cost of $5B. The density chart below represents 100,000 such pulls).

Simulating Content Costs of Game Pass

Based on this, Microsoft would most likely spend ~$7B per year to maintain similar volume. At $120 per user per year, this means 53M subscribers or about 5x the current amount to break even. At a 60% profit margin the number of subscribers jumps to 93M or more then the current Xbox Live MAU. Microsoft needs more users for this to work and they know it. Of course, perhaps this volume is insane and Microsoft wants much fewer but higher quality hits. In this case, however, the entire cost-savings model of subscriptions to the consumer declines. Our gaming subscription paradox re-emerges: subscriptions make increasing sense to the consumer wherein they would instead pay for many distinct pieces of content. Like music. Or T.V.

In many ways this explains the expansion of Game Pass to PC, Project xCloud, and the new Xbox console subscription bundle. Subscribers are capped by those with a console and Microsoft wants to start to unshackle that cap. Netflix recognized this long ago with Roku, Smart TVs, and apps on every platform or hardware they could find. The ability to sell Game Pass on iOS or Android explodes the addressable market, but is dependent on Azure wrangling the explosive unit costs of streaming. Hello Sony and the Playstation user base.

Microsoft clearly understands the supply-side economics of making streaming work, but over and over again misses the fundamental difference in how players consume a game as opposed to a T.V. show. I’m not quite ready to short Microsoft, but critical questions remain in executing on this strategy.