The Game is Outside the Game

Matthew Ball’s 2024 gaming review paints an industry that had a good ride but is settling into stagflation. The Metaverse is nowhere to be found; instead, growth drivers like cloud streaming and GTA pricing replace it. If Stadia is the best we can do, we’re truly fucked. I wrote in agreement earlier this year with “Gaming’s Best Years Are Behind It.” I stand by the same pessimism, but there’s an essential factor that may well guarantee gaming’s growth: time.

Over the past decade, gaming’s largest achievement has been its pliability: it can adapt to any format—smart TV, smartwatch, smartphone, and increasingly health and financial apps. It’s not just a form factor; the business models bend too. F2P didn’t just take share from traditional box revenue; it expanded the audience of gamers. Now even Grandma plays Candy Crush. Without real momentum behind a new control factor (AR/XR), and with smartphone, console, and PC growth limits reached, the audience appears maximized. Surely, revenue will follow at some point.

The metrics demonstrated by early “gaming cohorts” suggest realtized growth that’s yet to revibrate among the DAU base. If we consider gaming itself a product, we observe that new cohorts are far more engaged age-over-age than in earlier generations. As a reminder, Roblox maintains 380 MAU, with about half the kids in the United States as active users. Roblox’s users are aging, and even if they churn from the platform, the more important question is whether they retain gaming as a whole, with spending power growing alongside income.

As the current Roblox generation ages and habits are maintained, new, more engaged cohorts will stack, changing the relative share of gaming engagement. Of course, monetization must follow as Roblox struggles to grow user spend. So far, they haven’t released monetization metrics as cohorts age.

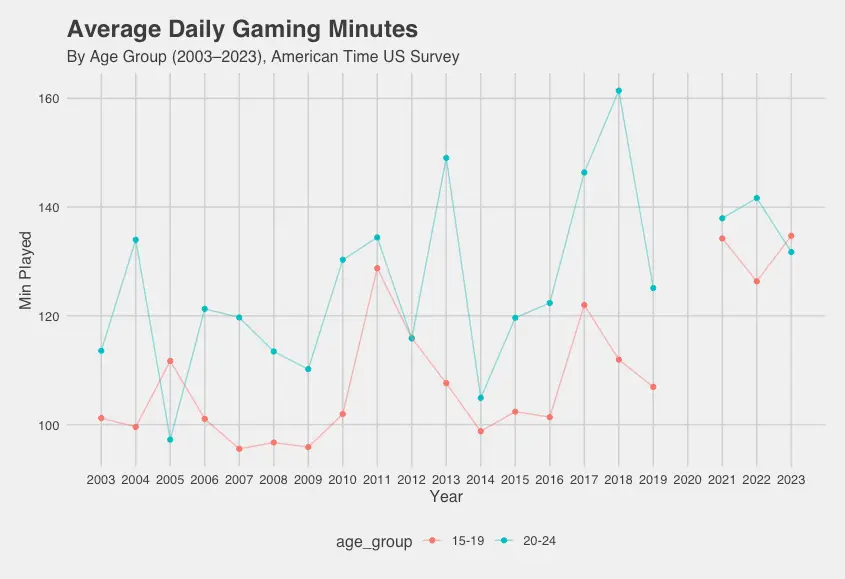

The best source for time trends comes from the American Time Use Survey, which gives diaries to Americans and has coders classify entries. Among 15-24 year-olds, minutes played per day is over two hours, up from 1hr 40min in 2023. This minimizes the Roblox effect, as those cohorts just reach maturity enough to be counted 15 and above in the survey.

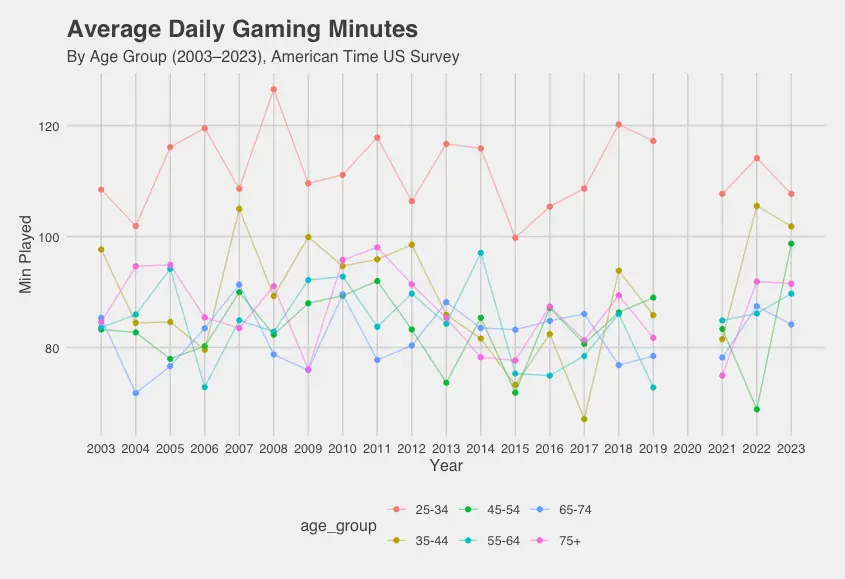

Not every cohort is up, however. Despite clear jumps in engagement, the new millennials (25-34) are not trending upward. In 2003, these cohorts would have been born in 1978 (Space Invaders), while the most recent age participants would have been born in 1998 (considered the greatest year in gaming of all time). It makes sense, then, that the 25-34 year-olds are poised next to see these most engaged cohorts enter the pool.

Meanwhile, the rest of the age groups are holding onto COVID highs but show no obvious long-term growth.

It’s important to remember that the coders for the time use survey have to follow strict rules on categorizing entries. The specific games category includes the computer, so it’s unclear if mobile games would fall in the same code:

- Playing games on the computer (including Internet games): Code as

Socializing, Relaxing, and Leisure/Relaxing and Leisure/Playing games

(120307).

Still, it’s puzzling how stable the trends are for the rest of the age cohorts. Are 75 year olds really playing an hour of games per day?

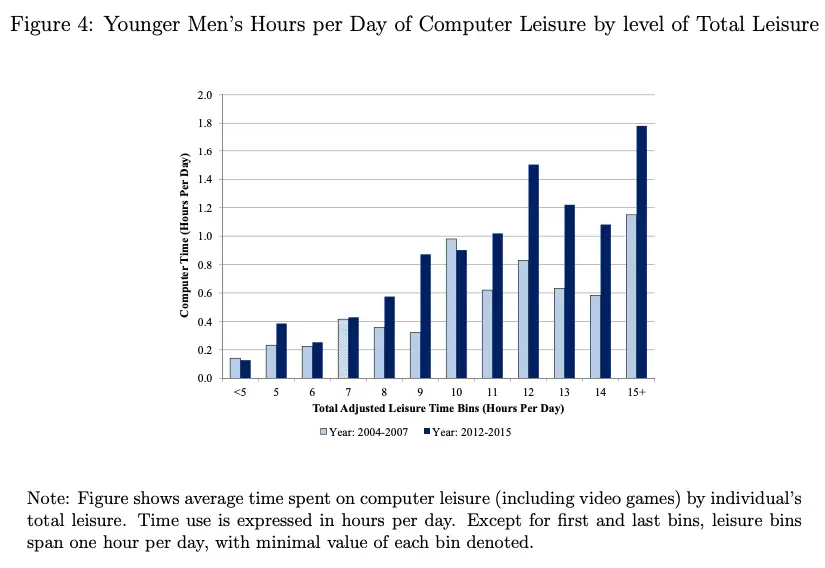

At least multiple reports have picked up on the rise in young men’s gaming habits, enough to cause controversy as a scapegoat for lower labor force participation. This has doubles down on a shift in gaming comprising a larger share of total leisure time. In other words, as consumers exhibit more leasure time, we find that they spend it increasingly on gaming.

The holy grail is more longitudinal data of consumer preferences over time. Fortnite is celebrated as a graduation game from Roblox, but it’s unclear if that’s reality or if engagement instead withers away in place of other obligations. For gaming to remain relevant, it needs to continue to bend across age groups, with the NY Times Wordle as relevant as Star Stable in monetizing over the lifetime of a customer.