1. It’s Distribution or Bust, and No One Cares

IDFA is gone; how is your game designed to maximize distribution? Game designers, not marketing managers, need to start building for *sustained* user acquisition. Adding an influencer as a cosmetic is a nice stunt, but it’s not fundamental to the game loop. I was surprised at the dearth of these questions relative to the AI focus. If the Chinese refuse to divest TikTok, this question will become more pressing over the next year.

2. Web3 Evolved from Shipping No Product to Previewing Bad Product

Shrapnel, the web3 FPS developed by devs with actual game industry experience, was playable. It was…bad. The official launch is targeted for 2025, so there’s time to fix the issues, but this is another hopeful breakthrough that’s become doubtful. It’s still progress for web3, which usually lacks products of any kind. Crypto Unicorns, another game with actual product, opted for a giant unicorn display statue instead.

3. There are Four GDCs, and I’m Doubtful They’re Merging

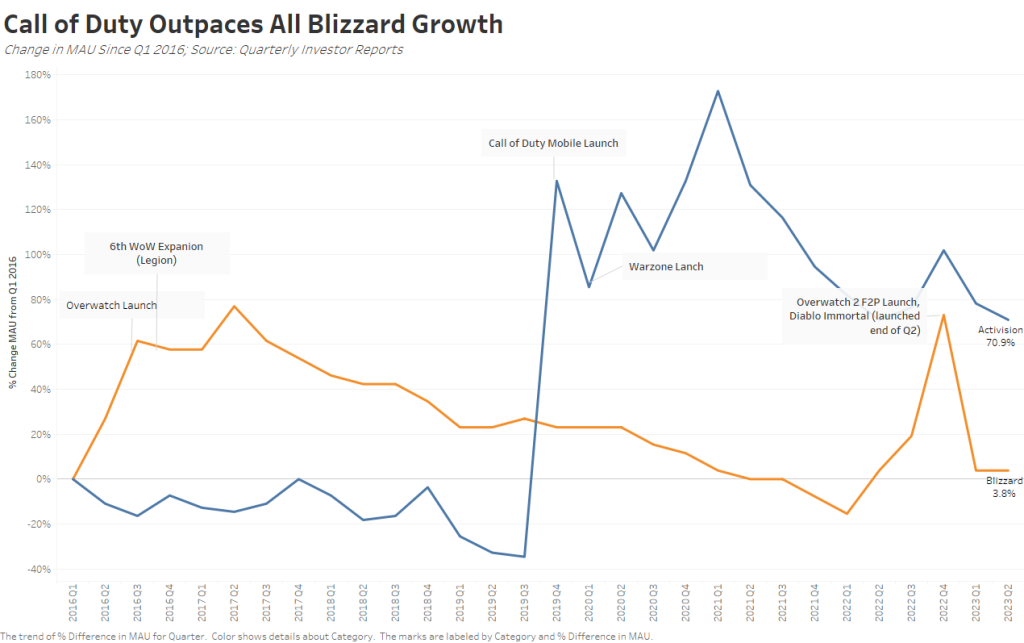

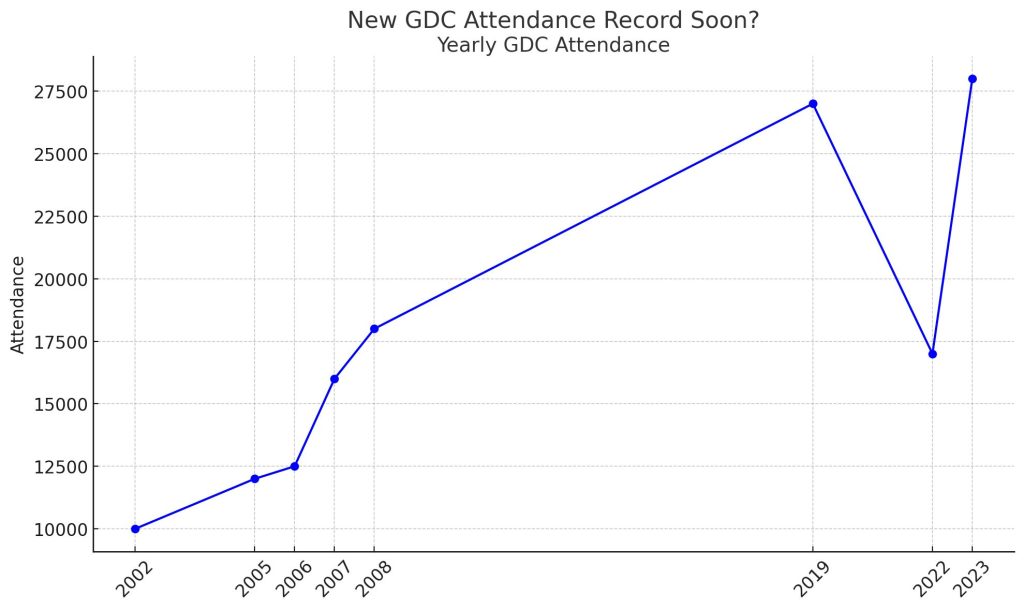

There are separate GDC experiences for VCs, mobile, HD, and web3. Each has its own parties, personal, and drama. I keep thinking these worlds will merge, but it’s been at a sloth-like speed. The continued wave of dual-SKUs (hello, CoD Warzone, and Delta Force) shows product signs, but the actual circles employees run in remain distinct. I’m keen to see the final tally for this year’s attendance, but I sense a new record.

4. A Lot is Riding On UEFN

No one cares about Roblox because the 70%+ tax means studios will never scale. The top of the market, Adopt Me, does $50M in revenue, and it’s all downhill from there. UEFN allows an off-ramp to distribution on EGS or Steam and a much more favorable cut. Beyond anything else, UEFN will enable creators to prove product-market fit when raising another round, but Epic needs incredible roadmap execution. Key items have already slipped.